Looking for ways to enhance the security of your ecommerce business? Check out this new fraud prevention tool!

Any business can become a target for fraudulent activity. The consequences can be severe in some cases. Kount is a new tool that provides a high level of fraud prevention to ecommerce companies and other businesses. Keep reading to learn more…

Gone are the days when one could peacefully run a business without the dangers of deception. If you’ve been in business long enough, you know how drastically times have changed. Even a decade ago, fraud wasn’t as rampant as it is today. With advancements in technology, businesses can accomplish a lot more than they could in the past. However, fraudsters have also upgraded their methods.

In this article, you’ll learn about:

- A new ecommerce fraud prevention tool: Kount

- Why security and fraud prevention are important

- Various fraud prevention tools

- What Kount is

- How to use Kount

- Why use Kount

- How to set up Kount

As a business owner or manager, the last thing you want is to deal with fraud. This is true for all businesses including those that are in the ecommerce space. It can cause more than just financial loss for you. In fact, fraud can jeopardize the very existence of a business. At Acumen Connections, Wichita payment processor, we take credit card fraud prevention very seriously. That is why we recommend staying in the loop when it comes to new and improved solutions for fraud prevention. Speaking of which, have you heard of Kount?

What is Kount?

Kount is an industry-leading tool that offers fraud prevention in ecommerce, mobile transactions (m-commerce), and transactions where a card is not present. It uses artificial intelligence (AI) to provide risk analysis and fraud assessment in real time.

Kount automatically approves, declines, or holds transactions as part of its fraud prevention strategy. It also assists with disputes and chargeback management.

Andrew Stoffregen is our resident expert on all things payment processing. We decided to pick his brain.

Andrew shares, “Kount is something we’re really excited about as we know it can significantly help our payment gateway merchants. Reducing fraud and earning more money – isn’t that what every business wants?”

Why is security and fraud prevention important?

There are many reasons security is crucial when it comes to business transactions. Security can prevent:

- Chances of identity theft

- Chargebacks

- Loss of business reputation

- Decrease in customer volume

- Decline in sales

- Losing the ability to accept cards

- Risk of going out of business

All of the above are real consequences of fraudulent activity in ecommerce and other business transactions. Your business might be able to recover from a fraud incident, but why take the risk? It is vital to protect your business and your customers at the same time. Fraud can impact both parties.

“It is always better to be safe than sorry,” says Andrew. He adds, “Credit card fraud and chargebacks can happen to any business. I’ve helped my fair share of businesses through that. We have options available to help prevent it from happening to you. I think it’s worth getting Kount. Why take unnecessary risks?”

Regardless of whether you operate in the ecommerce space or not, online security is a must for all businesses. This is because most businesses today have an online presence and take online transactions. There are other equally damaging things out there than just credit card fraud. We want you to stay safe. Take a look at our blog on Cybersecurity for Businesses.

Credit card fraud is when a miscreant gains unauthorized access to someone’s credit card with the intention of making purchases. As such, the charges will be billed to the card holder who didn’t make the purchase.

Kount can protect a business from selling to someone with a stolen credit card. When such a transaction goes through, the actual card holder might do a chargeback which takes funds away from the business. The business may also suffer a blow to their reputation for allowing such a transaction.

Learn more about the types of fraud that can target a business.

What are fraud prevention methods?

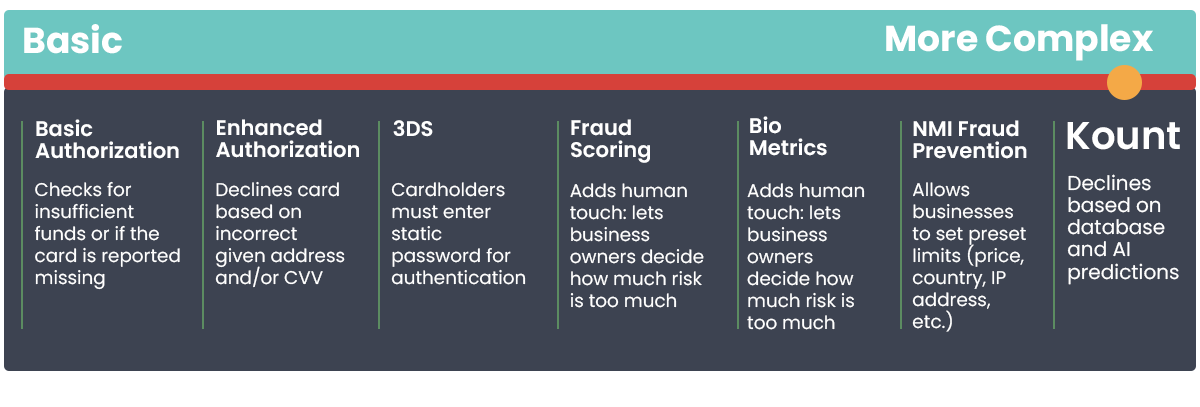

Any strategy to reduce fraudulent activity falls under the category of fraud prevention methods. It could be something as simple as training employees to watch out for fraud when accepting payments. It could also be utilizing tools to prevent unauthorized access to accounts or takeovers.

When it comes to credit cards and debit cards, there are different ways to decrease the chance of fraud. A customer that manually swipes, taps, or chips their debit card and has a valid photo ID bearing the same name as that on the card has a higher chance of being a legitimate card holder. If one or more of those elements are removed, the risk of fraud increases incrementally.

A customer not knowing their pin number or signing the wrong name could be red flags. When the card isn’t physically present for the transaction, it can increase risk. There are “card present” transactions and “card not present” transactions. The only way to have a card present and still commit card fraud is to have physically stolen the card.

Credit cards can get physically stolen. More common, is for miscreants to steal credit card data. That’s all you need to make a purchase over the phone or online.

Online transactions may carry some risk. Any online or ecommerce purchase is considered a card not present transaction. There’s a higher risk to online sales than in-person sales. That’s why shoppers are asked to confirm their address, CVV, and card expiration date when making a payment online.

If you manage an ecommerce company, your entire business is online. Hence, accepting secure payments should be a priority. Thankfully in today’s modern age, you have options.

Not all fraud prevention is built the same. There can be layers to it. Look at our sliding scale below to see the iceberg of various security options out there. We’ve ordered them in a way from basic to most complex.

What is fraud detection and prevention?

Fraud detection is the act of noticing and identifying fraudulent activity within an ecommerce set-up or any other organization. It could be identifying someone trying to make a purchase using a stolen credit card by seeing that the name on their photo ID and credit card don’t match, then stopping the sale.

Fraud prevention includes a plethora of steps and procedures. These are put in place to thwart any illegal activity pertaining to ecommerce or any other type of business. Most businesses have several fraud prevention elements set up to protect them and their customers from scammers.

- PCI compliance

- High ticket items

- And tools like Kount

All work together to keep your business safe from credit card fraud and chargebacks

Kount is an award-winning tool

Did you know that Kount has won a few noteworthy awards over the years? It has a rather impressive history of claiming several Card Not Present (CNP) awards over the years.

How to use Kount?

Let us take care of it for you. Just contact us and we can discuss your unique needs. It can seamlessly integrate with your Acumen Connections payment gateway. It will help ensure your transactions are more secure.

What does Kount do?

Kount performs a number of functions. They are:

- Preventing digital payment or ecommerce fraud

- Managing disputes and card chargebacks

- Protecting from account takeover

- Lowering business’ costs associated with fraud

prevention costs less than responding - Reducing false positives on approval

- Improving overall operations

- Enhancing security

- Providing customer insight through the use of AI

- Automating transaction decisions

At Acumen Connections, we take pride in the quality of support we provide. For any issues, you can always count on us for tech support and more.

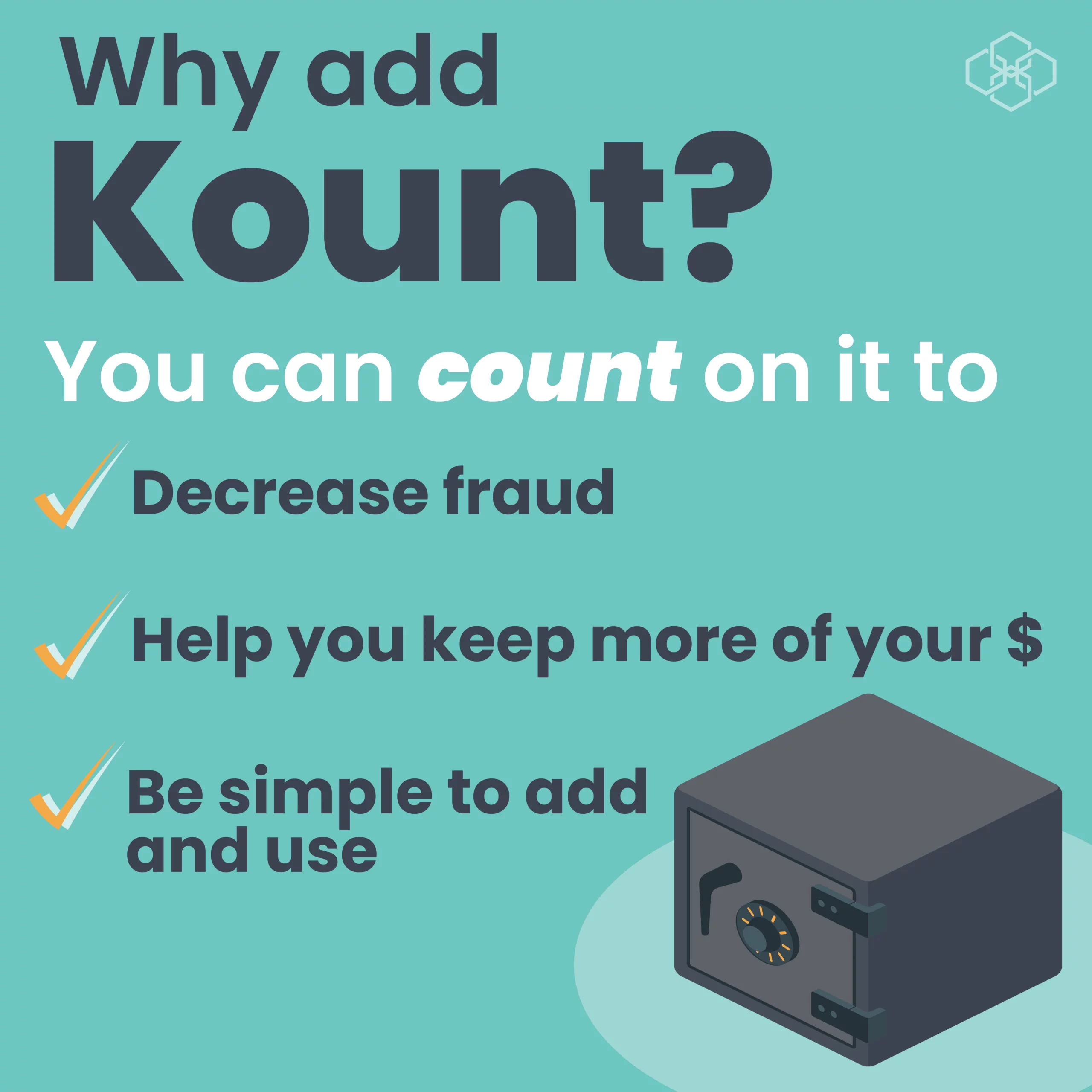

Why Kount?

Well, why not Kount?

When offered an award-winning AI-driven advanced tool to secure your business, there simply isn’t a reason to refuse. We have listed a few reasons why you need to say yes to Kount:

- Avoid criminal chargebacks

- Decrease fraud

- Easy to add

- Works with supported platforms like Shopify, Magento, CommerceCloud

- Pricing depends on transaction volume

A few additional features of Kount:

- Automated workflow

- Insights Dashboard

- Customization options

- Machine learning

- Device incorporating

- Chargeback guarantee

Closing thoughts

We hope this piece gives insight into Kount and why you need to consider it for your business. There’s nothing like being “too safe” when it comes to the things that matter. You wouldn’t skimp on security when trying to protect your family. Why take chances when your business is on the line? With Kount, you have nothing to lose and a whole lot to gain. Advanced technology and AI have made it a premier fraud prevention tool. Get it for your business today!

More from Acumen Connections:

To have access to an all-encompassing platform for business tips and more, check our blog.

Anna Reeve, MBA