Your guide to understanding credit card interchange fees, created by an expert!

You want the best for your business, and a large part of that depends on understanding the nitty-gritty of the trade. Credit card interchange rates may not be the first thing you think of, but it is vital to know how they work so that you understand your monthly statement. Stick around, and our payment processing expert will decode it all for you.

Running a business is one thing, but running a successful business is on a whole different level. There’s so much that goes into the day-to-day functioning of a business. From inventory management to hiring the best candidates, there is a plethora of things to be done and they need to be done well.

When it comes to charging your customers for products and services, you may have a POS system for small business, credit card reader, and other checkout solutions set up in addition to accepting cash. With payment processing often comes debit and credit card interchange fees. Simply put, for a business to accept debit or credit card payments, it needs to pay credit card interchange fees. Nobody likes fees—but the alternative would be to not accept card payments. Did you know that 73% of customers that don’t carry cash would leave a store without purchasing if they couldn’t make a card transaction?

In this article, we will explore credit card interchange fees and what they entail. As a processing provider, we are dedicated to maintaining transparency about our rates and fees so that you don’t have to second-guess anything. We want our merchants to understand these rates and fees better.

To explain the impact of credit card interchange rates on businesses, we asked Andrew Stoffregen, Customer Support Specialist at Acumen Connections, to share his thoughts throughout this article.

What are credit card interchange fees?

When a business accepts a card payment, it pays a fee for that transaction. This fee is paid to the card network or the bank issuing the customer’s credit or debit card. The fee covers operation costs and fraud risks. Debit card and credit card interchange fees form the meat of your credit card processing expenses. These rates are set by credit card networks and may vary by network. Your payment processor does not control these fees.

Average credit card processing fees

If you’re trying to estimate what your credit card processing fees might be, this section is just for you! Typically, the average is 1.8% for credit cards and 0.3% for debit cards. Please remember that these are only averages and what you might be paying is most likely part of a broad range of rates.

Andrew says, “Most businesses don’t realize that interchange rates can change twice a year: every April and October. Businesses may be faced with a surprise during Q2 and Q4 if they’re paying close attention to potential interchange rate changes.”

Explore updated interchange fees for Visa, and Mastercard.

How are business impacted by credit card interchange fees?

Andrew adds, “Interchange fees can have a big impact on businesses. Interchange rates are often based on the card type and transaction method. Some businesses like having more control over their processing fees since they’re able to control which types of cards they can accept, which can help decrease their expenses. While other businesses—especially ones that average $500 per ticket, take card-not-present transactions, or prefer better accuracy for their processing cost predictions—may not like interchange rates and may prefer a flat-rate system.”

How are debit card and credit card interchange fees calculated?

These fees are established by the major credit card associations like Visa, Mastercard, Amex, and Discover. Every association has their own rates and schedule of fees, which are determined by several different factors. We recommend spending time understanding your monthly payment processing statement for clarity.

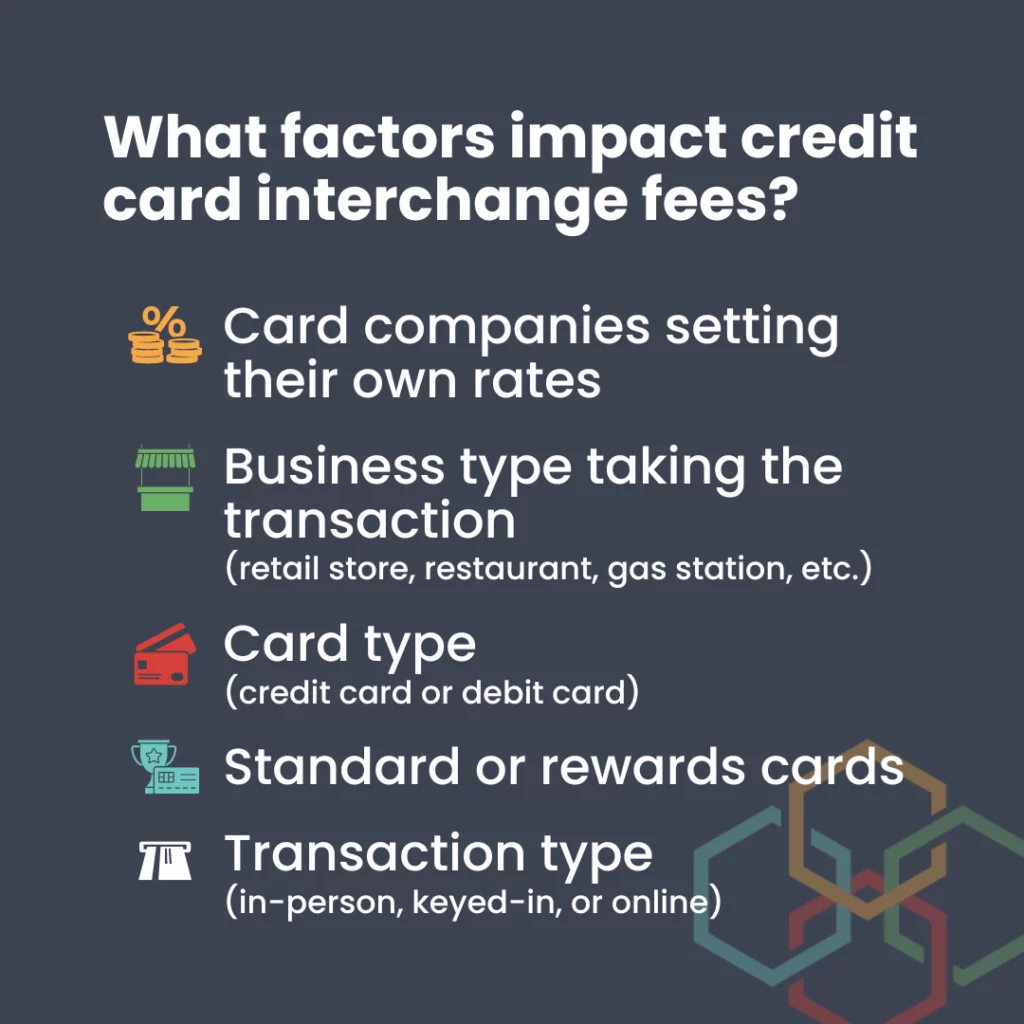

Factors determining credit card interchange fees

There are a few factors that impact credit card interchange fees. They are:

- Card companies setting their own rates

- Business type taking the transaction (retail store, restaurant, gas station, etc.)

- Cardholder type (regular customer, business, non-profit, etc.)

- Card type (credit card or debit card)

- Standard or rewards cards

- Transaction type (in-person, keyed-in, or online)

Debit card interchange fees

You may have observed that debit card interchange rates are lower than credit card interchange rates. This is partly because debit cards carry lower risks than credit cards.

Debit card transactions can successfully go through if a customer has sufficient funds in their bank account, so there is very little risk involved. Since these transactions often require the customer’s PIN, it also provides a safe way to confirm their identity. There’s also less chance of a chargeback on a debit card than with credit cards.

How are credit card interchange fees charged?

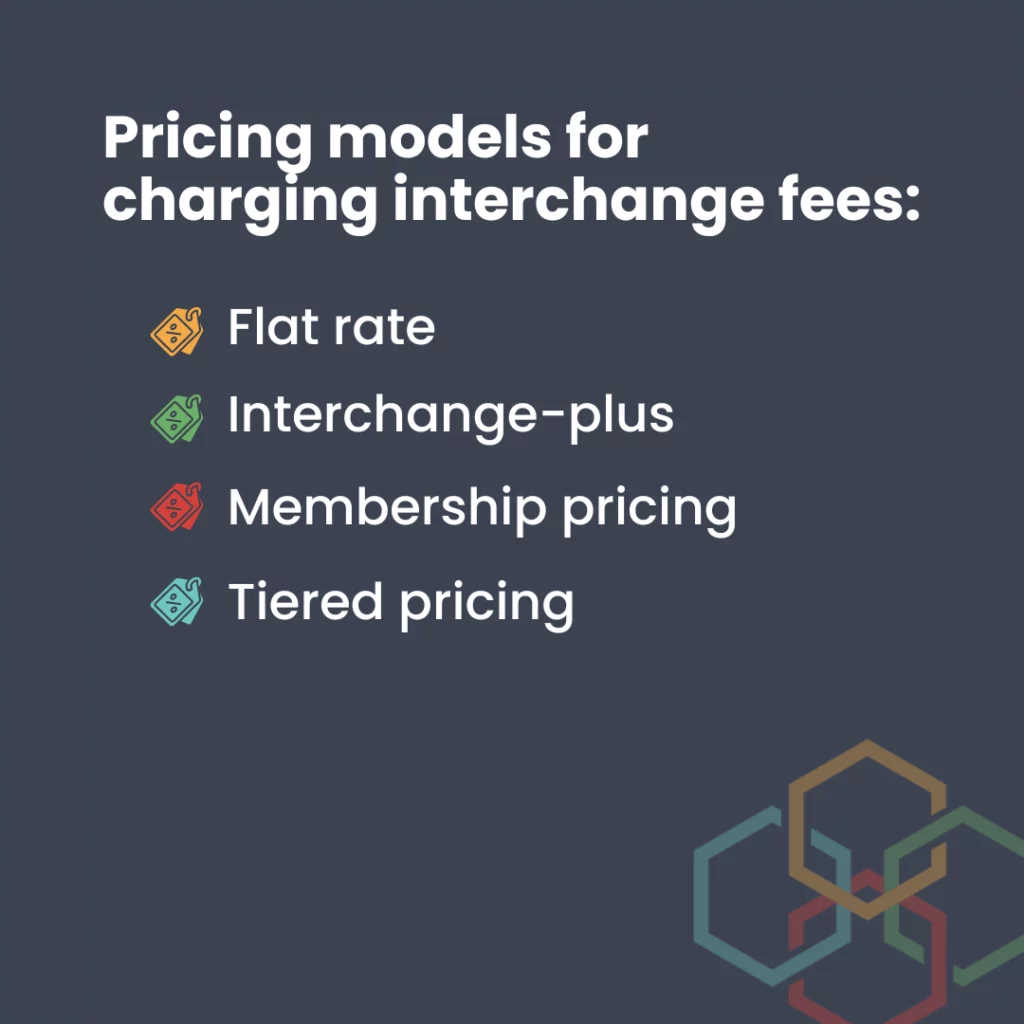

There are four ways that debit card and credit card interchange fees may be charged to a business. Let’s explore them:

1. Flat rate

This is a very simple and easy-to-understand rate structure and works best for small businesses that process less than $5,000 a month. A flat-rate processing fee is charged for every transaction regardless of whether it is a credit card or debit card being used. It also doesn’t consider whether the card was Visa or Amex.

Providers like PayPal and Square use this model. Acumen Connections does have this option for our merchants as well.

Pros: Suited for small businesses, fees are predictable

Cons: Not suitable for larger businesses as they could end up paying more under this model, no lower rates for debit card transactions

2. Interchange-plus

Transparent pricing makes this model a hit among small- to mid-size businesses. There is separation of interchange fees and markups, and they charge different rates depending on the type of card (debit or credit, if it’s a simple card or rewards card, etc.).

Businesses that process anywhere from $5,000–$15,000 a month can save a good amount by using this pricing model. The Acumen Connections merchants that don’t utilize our helpful merchant discount programs prefer interchange-plus. They like the transparency of pricing.

Pros: Markups are clearly specified, lower rates for debit card transactions

Cons: Hard to predict cost

3. Membership pricing

Businesses processing over $15,000 a month may benefit from this pricing model. Here, the processor markup is clear and there’s one fixed fee for every transaction instead of a percentage. However, there is usually a subscription or membership fee involved.

Pros: Processor markup is disclosed, works great for large businesses

Cons: Monthly subscription fee, not fit for small or seasonal businesses, not many payment processors provide this option

4. Tiered pricing

This model attempts to simplify pricing for processing, but there are several drawbacks. This model classifies transactions into qualified, mid-qualified, and non-qualified. The goal is to ensure that the processor profits from every transaction regardless of interchange rates and hence, the business might have to pay a high markup. Markup costs are obscure as it is lumped together with interchange fee. There is maximum profit for the processor but at the cost of the business.

Pros: None

Cons: Unclear markup, no lower rates for debit card transactions, very expensive overall

Interchange changes happening in 2023

Yes, there are changes happening to credit card interchange fees and we want you to know all about it! Before we dig deeper, here’s a closer look at the interchange rate changes in October.

Typically, Visa and Mastercard make changes to their fees twice a year. However, they didn’t do so for almost two years during the global pandemic. When they finally did make some changes last year, it was met with controversy. Rates had been raised for transactions where a card is not present due to a rise in online fraud during the pandemic at the peak of the ecommerce boom. The backlash was due to the post-pandemic economy going through inflation.

We know, this isn’t great for businesses but there are some things you can do to minimize the impact of processing rates.

The Federal Reserve ruled that debit card issuers and payment processors need at least two processing networks for all debit card payments. This includes card-not-present transactions, such as online purchases. To meet this, businesses can consider the use of tokenization and add a payment gateway to better secure their accounts. Along with this, businesses can also encourage customers to use their digital wallets for convenient payments.

Digital wallets are considered secure and often circumvent “traditional” card fees. A spokesperson from US banking giant J.P. Morgan recently stated that “merchants that do not take advantage of the digital wallet incentive will undoubtedly be leaving money on the table.” Experts are expecting to see an increase in the use of digital wallets over the next few years, which will help businesses save on processing rates. Fortunately, Acumen Connection merchants can accept digital wallet payments with ease.

In addition, businesses have learned the secret to eliminating their payment processing rates. 180,000+ businesses in the US have worked with a processor to adopt a merchant discount program. More and more companies are using dual pricing and non-cash adjustment programs to see major savings on their merchant processing.

Ready to join them and save big? See if your business qualifies to participate in one of our merchant service processing discount programs, today.

How do credit card interchange fees impact customers?

Yes, customers are impacted by credit card interchange prices, but only when their payment options are affected or limited because of them.

Andrew explains, “Most consumers don’t consider credit card processing fees, until a business explains that they no longer accept the customer’s card type.”

Shoppers enjoy convenience, rewards, points, and more from their card providers. It’s hard to regulate what payment options consumers bring to your store. This is especially true if the only incentives are from their favorite credit card brands, regardless of what it costs your business in processing fees.

To manage credit card expenses, customers should consider carrying several modes of payment such as cash, cards, and digital wallets.

Is that change likely to happen any time soon? Probably not.

A late 2022 survey claims that 41% of Americans do not use cash for their purchases.

What can we say? People like their cards!

Frequently Asked Questions

Naturally, you have questions. In this section, we’ll do our best to answer any queries you might have regarding credit card interchange rates and payment processing fees. Let’s get started!

1. Who pays interchange fees?

Debit card and credit card interchange fees are part of processing costs. The business running the transaction pays the fees to the card-issuing financial institution or bank.

2. Can you negotiate credit card interchange fees?

No, you can’t negotiate credit card interchange fees as these are determined by the credit card associations. Even your payment processing provider can’t help you reduce these fees.

However, you can ask your provider if they can offer you a discount on the provider’s costs. It’s worth a shot. They may have options to help your specific business save.

3. How can I save on credit card interchange fees?

There are a few ways you could potentially save on credit card interchange rates. We have listed them below for you:

- Use an Address Verification System (AVS) to lower fraud in transactions where a card is not present.

- Settle batches daily to avoid getting a higher interchange rate. It also prevents customers from getting confused when they see a charge on their credit card statement from a different day, and they might dispute it.

- Encourage customers to use mobile wallets. Just like debit cards, they have lower interchange fees.

- Avoid keyed-in transactions and manual entry as they have higher processing rates. Some restaurants take credit or debit card info over the phone before preparing a takeout order, whereas others encourage customers to come into the restaurant and pay.

- Check out our merchant discount program and take advantage of the options to save money.

Take a look at your options of programs that help save money on merchant services.

Closing thoughts

Credit card interchange fees can be the bane of one’s existence! Okay, that’s a slight exaggeration. Fees of any kind aren’t exactly what we want more of these days. However, sometimes fees serve an important function, and we must understand why we pay them.

Accepting in-person credit card payments and online transactions in a secure and convenient way is integral for any business. That’s why Acumen Connections is committed to empowering businesses like yours with the best payment processing solutions. Shop our hardware and software to find the credit card reader of your dreams, such as the popular Ingenico Desk 3500.

If you run an ecommerce business, you need a reliable payment gateway. Acumen Connections can make that happen for you. We go the extra mile to make sure you’re set up for success. Follow our payment processor blog and socials for the latest information on all things merchant processing. Contact us today and let’s talk about how much you can save!

Anna Reeve, MBA