Deep-dive into how “manually keyed” or “keyed-in transactions” impact your business.

There are times when instead of swiping a debit or credit card, the card details are manually keyed in to make a sale. Our resident merchant processing expert, Andrew Stoffregen, shares his insights on manually keyed-in transactions and what they mean for your business.

As a merchant, you’re accustomed to accepting payments in several ways. From cash, cards, online ordering, and digital wallets, you’ve seen it all. Often times, a customer will call your business to place an order and offer to provide card information so that you can process the sale once you have manually keyed in their card details.

Your customers love convenience, and this extends to how they pay for a product or service. Some prefer credit cards while others use cash. There are some that like using digital wallets. Although keyed-in transactions are to be done when there’s no other alternative – more on this later – they do make the process convenient for the customer at a cost to the merchant. Businesses thrive when their customers are happy. Take a look at these 5 customer service practices that make businesses great.

It is important as a merchant to accept all kinds of payments. In this article, we will focus on understanding manually keyed or keyed-in transactions and the impact on your business.

What are keyed-in transactions?

Keyed-in transactions may be described as transactions where card details are manually keyed, or typed, into a card reader instead of going the tap/chip/swipe route. Most of these transactions do not have the card physically present.

Difference between swipe and manually keyed transactions?

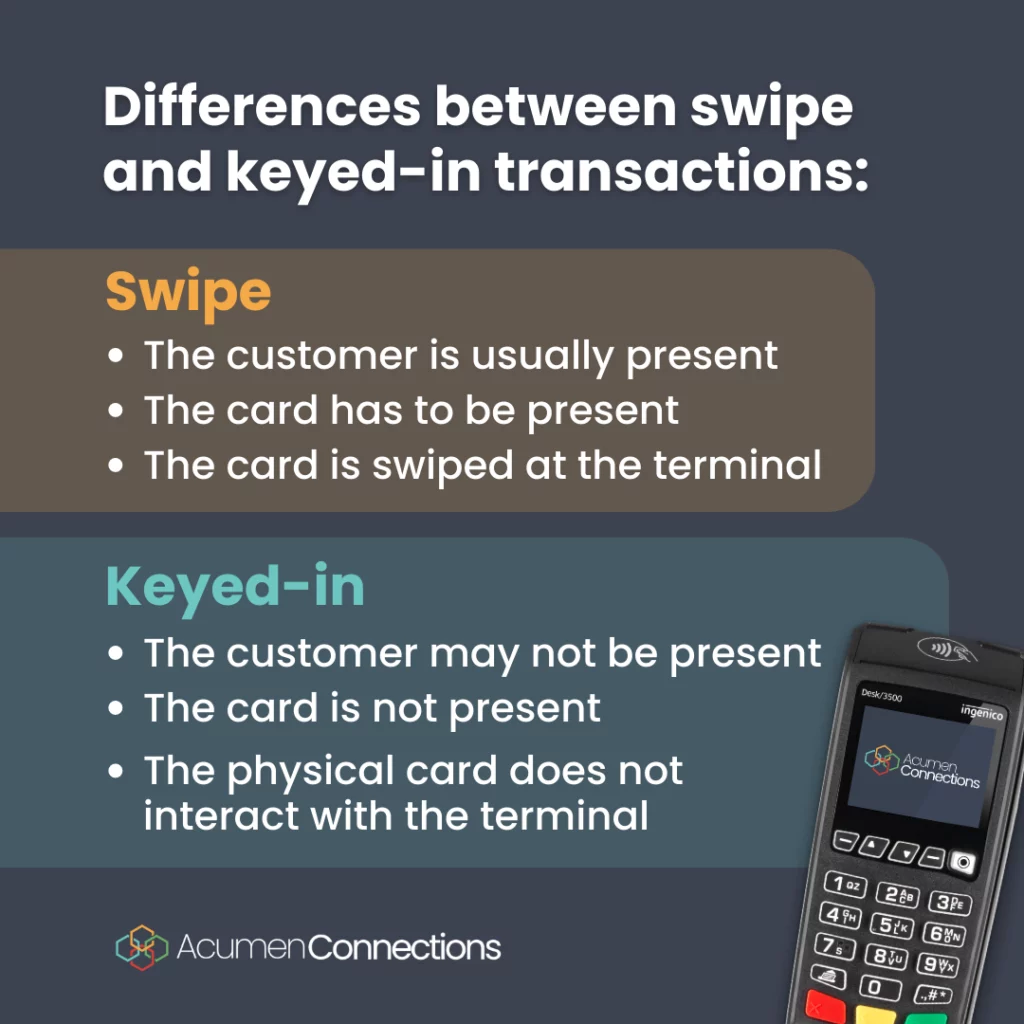

There are a few differences between swipe transactions and keyed-in transactions like:

The physical differences are small, but they have some big impacts. For starters, manually keyed transactions often come with more risk, and therefore a higher processing cost.

Let’s break apart some of the risks, and rewards, for both kinds of transactions.

Advantages and disadvantages of swipe transactions

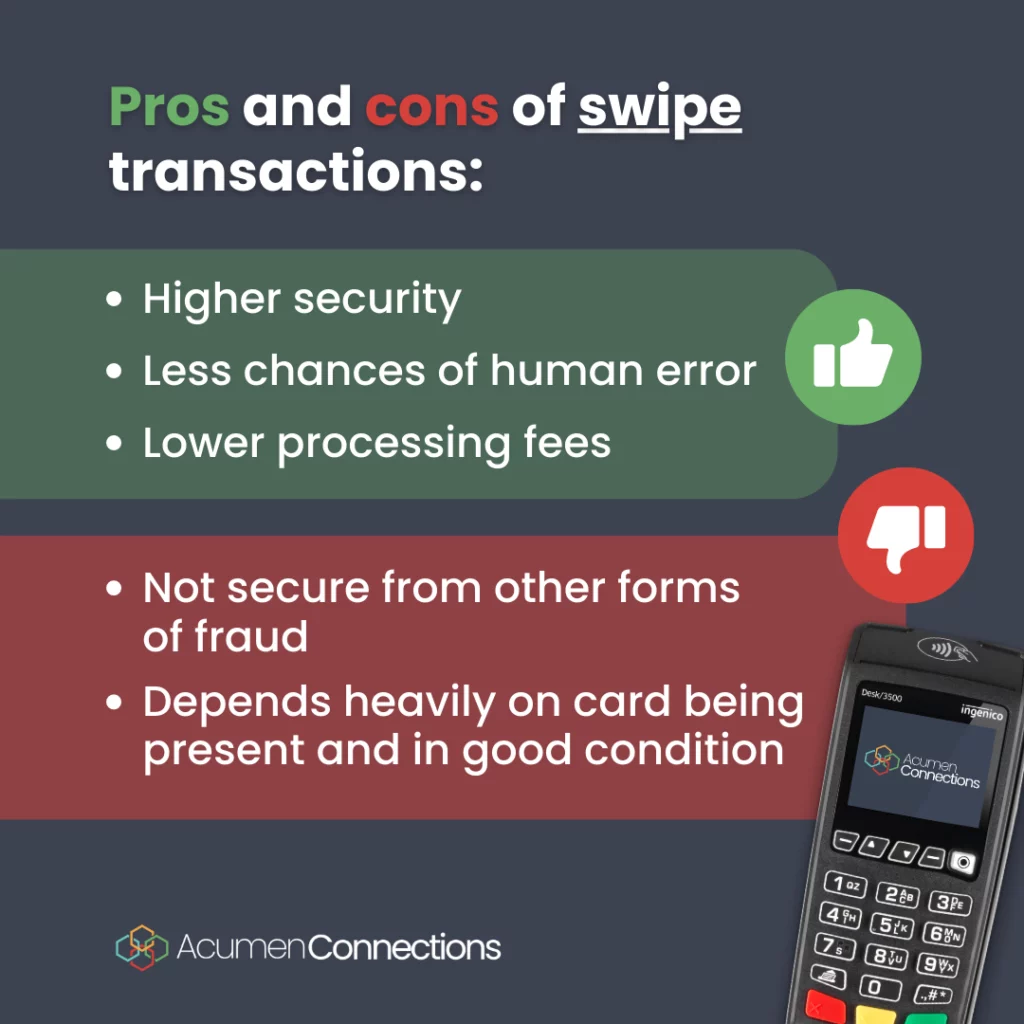

With swipe transactions, it’s often the customer engaging with the credit card machine and their card. In these transactions, the card is present, and the customer is there too.

We have listed below the advantages and disadvantages of swipe transactions and the customer’s actions at the credit card machine:

Why do we need keyed-in transactions?

There are a few reasons businesses might use manually keyed or keyed-in transactions. Let’s take a look at when and why merchants may use them:

- Payment is charged before or after the service and the customer is not present

- It is inconvenient for the customer to leave their home

- The customer is based out of a different city or state

- The merchant experiences technical issues with the credit card terminal

- The customer’s card is faulty (bent or scratched on the magnetic strip etc.)

How to perform keyed-in transactions?

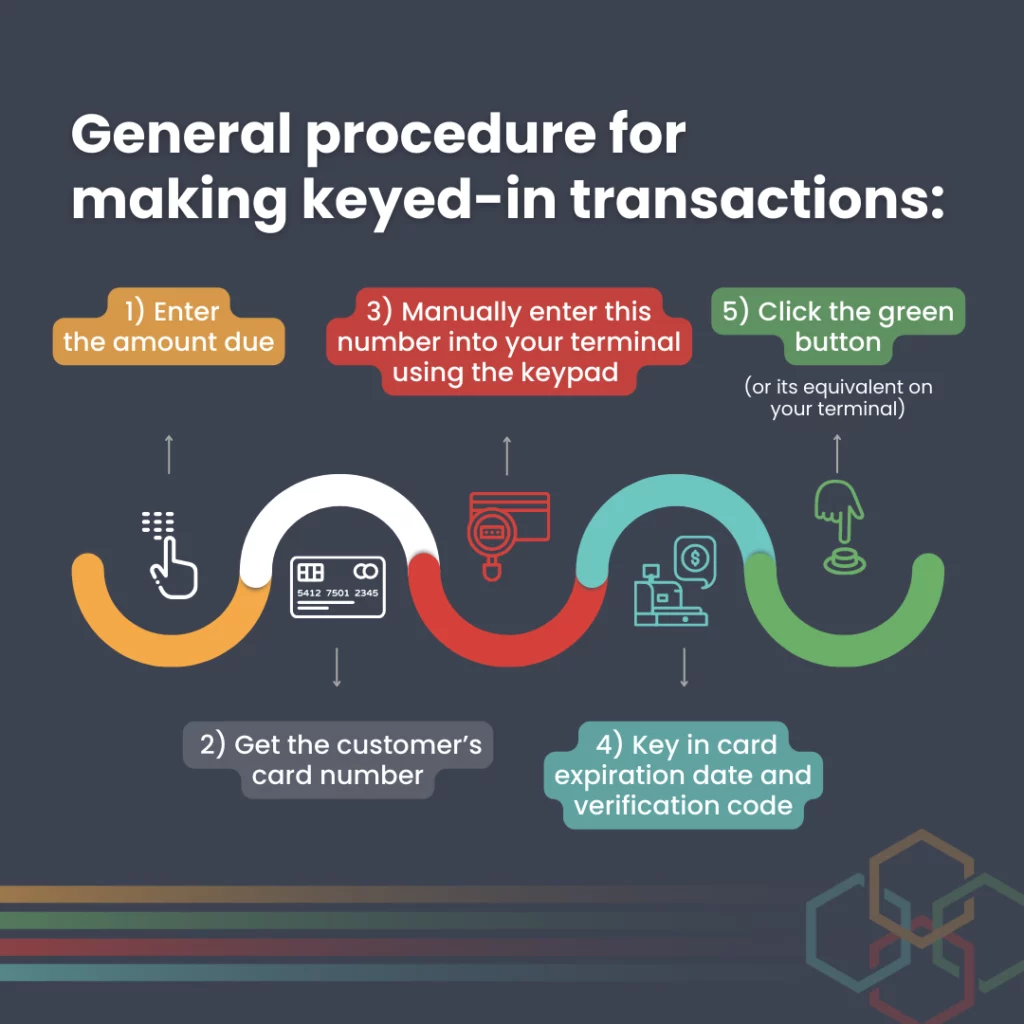

The exact step-by-step process to make a manually keyed transaction may differ from terminal to terminal. There are a few steps for a merchant attempting to make keyed-in transactions.

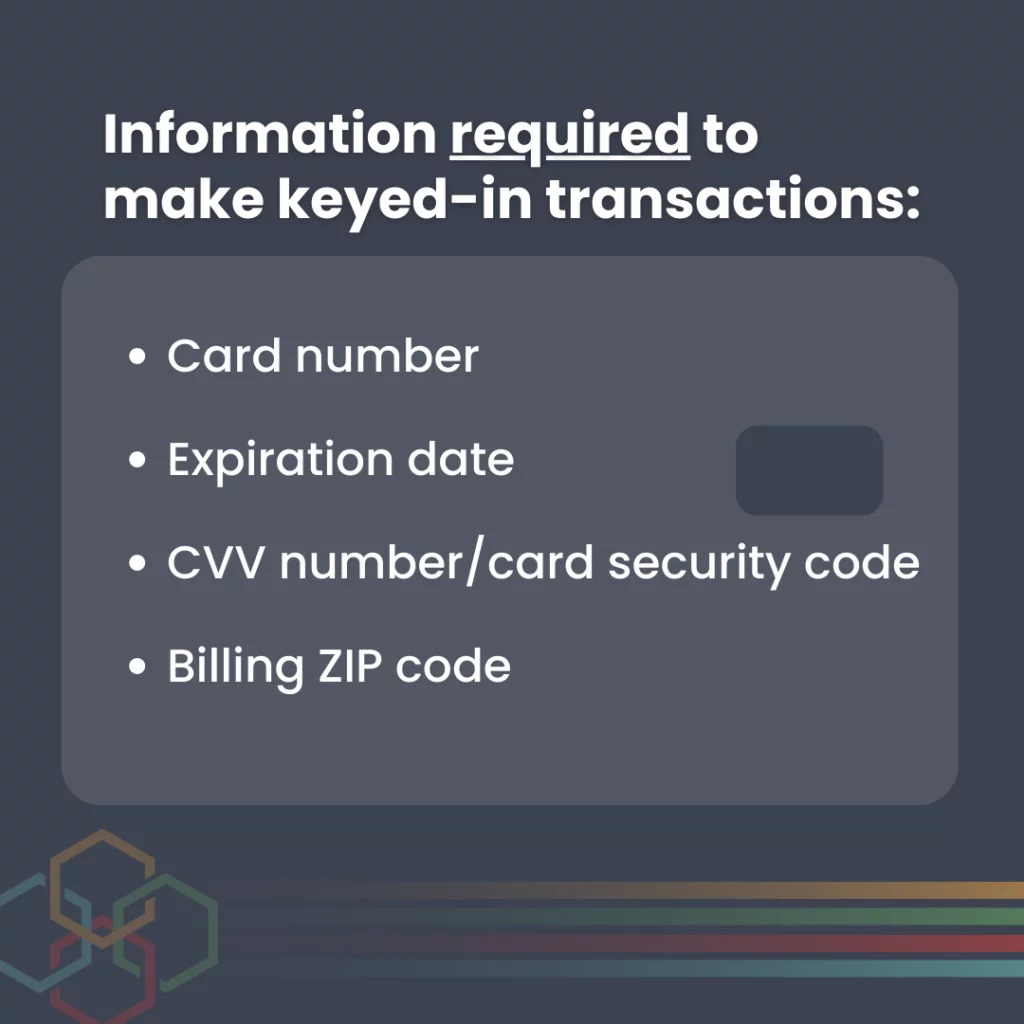

These are the basic steps to perform keyed-in transactions. If a merchant has a few pieces of information from the customer’s card, they can process a manually keyed transaction.

We recommend getting additional information like the customer’s name, billing details, zip code etc. If the customer is present at the time of the sale, make sure to get their signature on the receipt!

Keyed-in transactions – Only when necessary?

Manually keyed transactions are by no means the default way of processing payments. They should be carried out only when there are no alternatives. As in, if the customer has no other way to make the payment. At the other end of extremes, you obviously don’t want to turn someone away from your business. A merchant might make exceptions from time to time, but it’s advised to stick to taking payments via regular means like cash, cards, or digital wallets.

Andrew Stoffregen, our merchant processing expert, states, “The chips, magnetic stripes, and tap-to-pay features on credit and debit cards aren’t just there to be quick and convenient. These are part of the security protocol that ascertain that a customer and their card were physically present at the location where a sale was made.”

Paying in-person creates a sort of digital footprint that provides peace of mind for all the parties involved.

- It assures the merchant that this card DOES belong to the person listed on it, and that they willingly agreed to make the payment.

- Banks and the card networks are always vigilantly on the lookout for card and identity theft attempts. This assures these same teams that the card DOES belong to the person listed on it, and that they willingly agreed to make payment.

- There’s also peace of mind for the customer, as they’re there, and more likely to remember the charge when reviewing their monthly bank statements.

What are the advantages and disadvantages of keyed-in transactions?

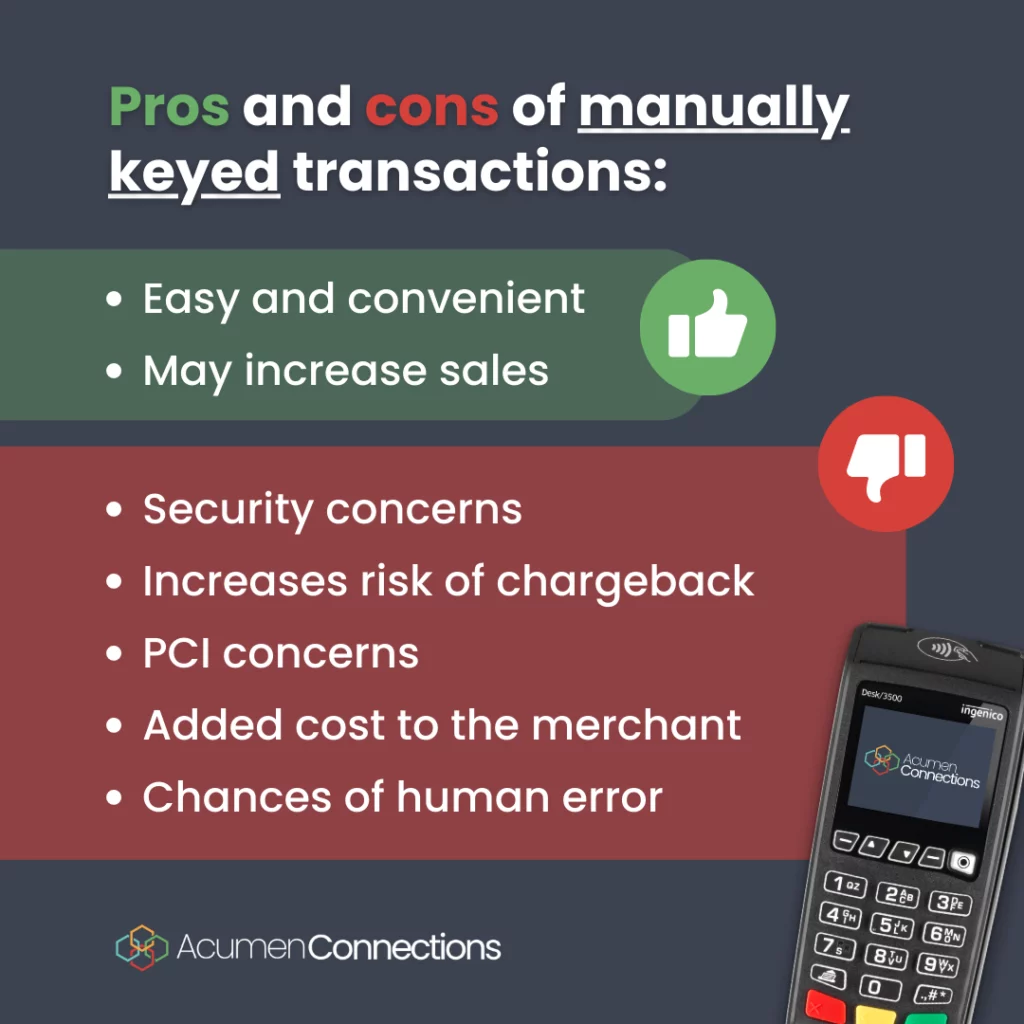

The main advantages of keyed-in transactions are convenience to the customer and the possibility of an increase in sales. However, keyed-in transactions have a few disadvantages.

Let’s take a closer look at some of these keyed transaction risks.

1. Security concerns

There is always some level of security concern when a merchant performs a card-not-present transaction.

Fraud may be internal (caused by a person or entity within an organization) or external (caused by forces outside of the business) can both easily happen when there’s no card present for a sale.

An employee committing fraud by charging a customer without authority or even just using stolen card information is a textbook example of internal fraud. We can suggest a few ways to avoid employee fraud at your business. Alternatively, a customer using stolen credit card information is a type of external fraud.

In today’s modern world, it’s easier to steal credit card information than it is to steal a physical card. Between data breaches and card skimmers, it’s easy for someone to steal card information from anywhere in the world!

Someone could easily call and ask a merchant to run a charge on a stolen card. Did you know that 65% of credit and debit card holders have experienced card fraud? This makes over 150 million people in the country.

Discover how credit card information is stolen and how you can avoid it.

2. Increases risk of chargeback

From the start, it’s more likely for a customer to remember a purchase they made if they had been physically at the store.

Beyond that, it’s easier for a merchant to contend a chargeback when the physical card was used. It’s easier to contend a chargeback if the customer had to sign their name or enter a pin. Businesses often have cameras in their stores. Having footage of customers making payments Is an easy way to prove a transaction was legitimate.

It’s harder for a merchant to contend a chargeback when the card wasn’t present at the sale. It’s even easier to contend if you have video footage of the customer paying in-person at the store. In general, chargebacks are expensive and have a significant impact on the bottom-line of your business. Total chargeback costs surpass $30 billion annually!

3. PCI concerns

Did a repair person write down the customer card info in one place, and then take that info with them back to the office to perform a manually keyed transaction later? Writing down customer card info like that goes against PCI compliance best practices.

See a full list of PCI compliance requirements.

In cases where a representative of your company has to go out to a certain location for work, Acumen Connections has mobile POS devices a merchant can use to avoid such situations.

4. Added cost to the merchant

All in all, card not present transactions are riskier. This means they can cost the merchant more since there is a higher chance of fraud involved. That’s why credit card interchange rates for manually keyed transactions tend to be higher.

5. Chances of human error

As a merchant manually enters a customer’s information, there is always a chance that errors may occur. We all are prone to making mistakes when typing a number or any other information into a system.

Andrew explains, “Banks and card companies are ALWAYS on guard for anything that even smells like card/identity theft. They know that people and groups that steal people’s identities and card numbers will try to use them either online or over the phone, because all they usually have is the card number and CVV code. Due to this, the Interchange rates for running manually keyed transactions are higher.”

When the risks are high, the fees tend to be higher.

How to avoid keyed-in transactions?

As a rule-of-thumb, a merchant shouldn’t perform manually keyed or keyed-in transactions as a go-to option to collect payments. It is to be used only when absolutely necessary. Here are a few ways a merchant can avoid keyed-in transactions:

1. Ask customers if they have a different card or cash

If a customer’s card isn’t working, a keyed-in transaction is not the next step. Always ask them if they have a different way to pay. It could be a different credit or debit card, cash, mobile wallet etc.

This is the same for when customers order a to-go order. Many restaurants just ask them to pay in-person when they pick up their food.

2. Ensure that your terminal is updated and doesn’t have issues

Sometimes your credit card reader doesn’t work like it’s supposed to and so merchants must keep their devices up to date to collect payments. Call your merchant processing provider if your equipment needs upkeep.

3. Use a mobile credit card reader to collect payments on the go

Merchants can benefit from having a hand-held mobile credit card reader that helps accept payments anywhere. If you provide services away from your store or offer deliveries, giving people the option to swipe their card from the comfort of their home or office enhances customer experience.

Choose from a variety of credit card readers to find the perfect one for you.

4. Incentivize online ordering

Over 56% of customers prefer to shop online. That’s more than half of all customers! When someone calls in to place an order, mention that they can get rewards and discounts by placing an order through your website and making online payments.

If none of the above works, a merchant can offer manually keyed or keyed-in transactions as the last resort.

Keyed-in transactions – yay or nay?

We wish there was a clear-cut answer to this. Unfortunately, there isn’t. Keyed-in transactions are important when all else fails. If you’re thinking of avoiding keyed-in transactions at all, Andrew has news for you.

He says, “Hold your horses just a bit longer, because there are some advantages to manually keyed transactions as there are very legitimate reasons for taking card payments over the phone or at a different location.”

We realize that this might seem a bit confusing – manually keyed transactions having benefits but at the same time, we’re advising against using it when it can be avoided. Let’s break this down for you.

Our key takeaways:

- Manually keyed transactions sometimes make it easier for a merchant to take payments at checkout and might even help increase sales.

- However, the merchant will have to pay higher processing fees.

- There are security and fraud concerns that come with manually keyed transactions.

Andrew sums it all up with a one-liner: “As a merchant, use your best judgement and be proactive!”

For information on how our credit card processing team can benefit your business, contact us today!

Anna Reeve, MBA