A payment processor answers: How does a payment gateway work?

You’ve likely come across the term “payment gateway” on some payment processor websites. You may have questions about what a payment gateway is and how it works.

In a previous article, we discussed the difference between “payment processing” and “payment gateway.” They’re two popular terms that are thrown around a lot.

Today we take a closer look at payment gateways. We explain how they work and how they can benefit your business. We brought in our payment gateway expert to help. Andrew Stoffregen is our Customer Support Specialist. He’s an expert on all things payment processing.

Buckle up.

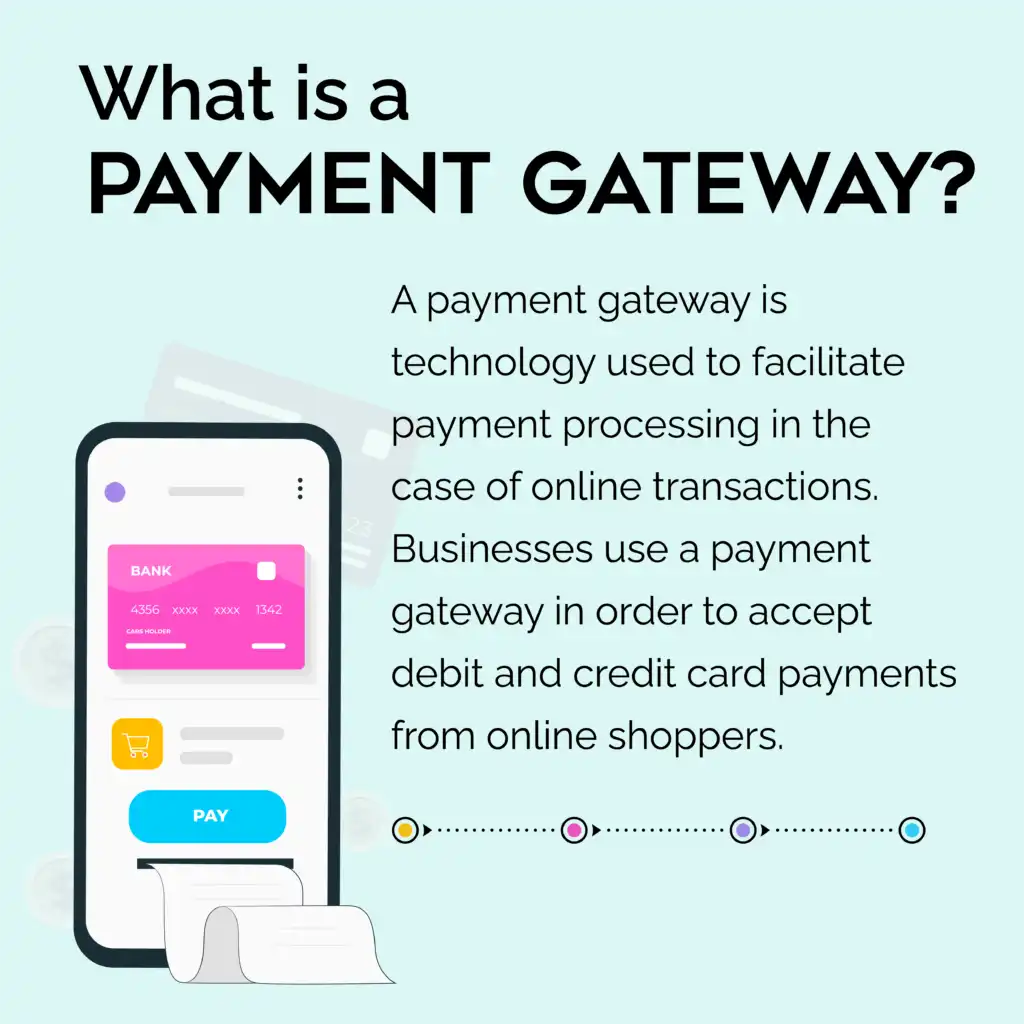

What is a payment gateway?

A payment gateway facilitates payment processing for online transactions. Businesses use a payment gateway to accept payments from online shoppers.

You’ve probably interacted with a payment gateway. Are you one of the 230.5 million US consumers that shopped online last year? If yes, then you have used a payment gateway. Remember entering your payment card information when you made your purchase? It would have been on a secure form. That was a payment gateway.

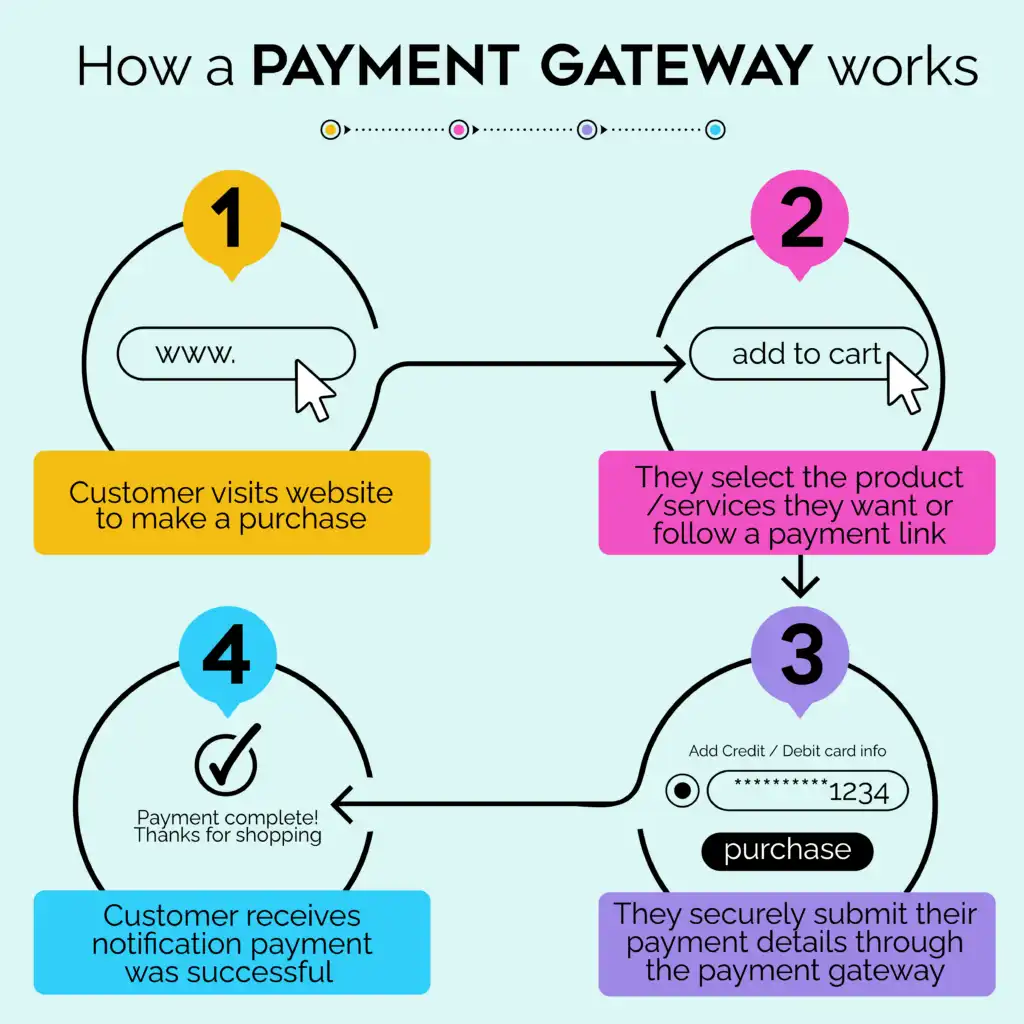

How does a payment gateway work?

You’re familiar with how a payment gateway works as a customer.

- Customer visits website to make a purchase

- Customer selects the products/services they want or follows a payment link

- Customer securely submits payment details through the payment gateway

- Customer receives notification payment was successful

That’s how the customer uses a payment gateway. But that still doesn’t explain the technical process. A payment gateway can feel kind of like “the wizard behind the curtain.” (As a Kansas payment processor, we had to reference Wizard of Oz.) There is a lot of magic happening behind the scenes.

Our tech expert Andrew says, “Some of the process only takes seconds. So, we’ll go ahead and explain what’s happening.” He describes the following steps:

- A cardholder enters card information. The business and its payment processor collect that info.

- The payment processor forwards the info to the cardholder’s issuing bank. The issuing bank determines if there are sufficient funds or credit for the purchase.

- The issuing bank informs the business and cardholder whether the payment was approved or denied.

- Steps 1–3 only take about 2–3 seconds on average.

- If approved, the payment processor captures and records the sale. The customer gets a confirmation number and digital receipt. The business gets a proof of purchase as well.

- At the end of the day, the business settles its batches. It submits its payment gateway sales to its payment processor.

- A couple days later, funds are transferred from the customer’s issuing bank to the business’ acquiring bank.

Check out our free eBook for more payment processing information.

Are payment gateways easy to use?

Yes. Payment gateways are easy to use and manage. “If you can use Facebook, you can manage your payment gateway,” Andrew says. Setting up or customizing can require some technical know-how. However, we are more than happy to help you set up your payment gateway if you’d like.

If you need help with a device, we’ve got you covered. “After all, we’re a friendly neighborhood payment processor. Helpful customer service is one of our perks,” Andrew adds.

We offer two payment gateway options. Let’s take a look at both of our payment gateways.

Here’s our first one: the Acumen Connections Gateway

This image shows you the back end of the payment gateway. This is what the merchant sees to manage payments.

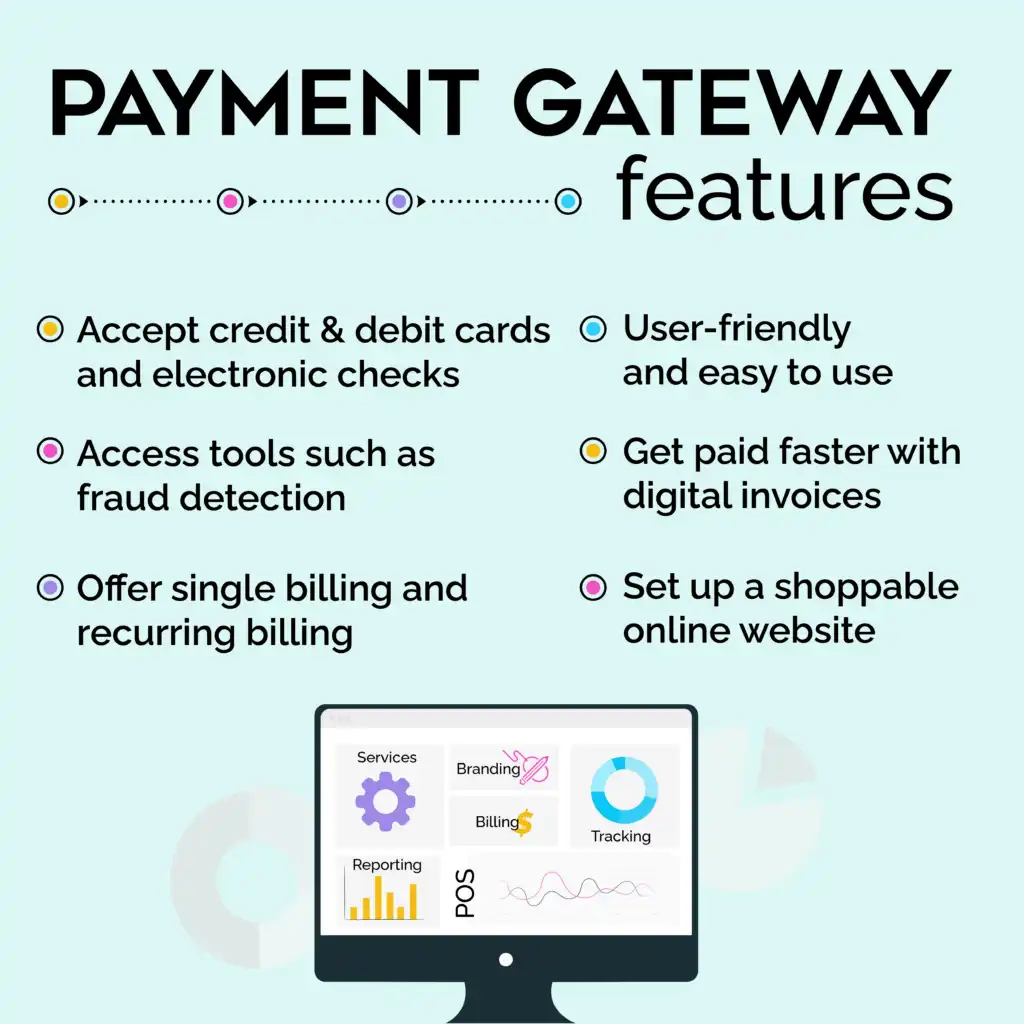

- Run sales with credit card billing information

- Set up recurring billing

- Create invoices with no extra charge

- Access payment links to add to social media and websites

- View batch history and configuration

- Add fraud prevention services

- View transaction reports

Andrew points out that the function called “Customer Vault” is perfect for businesses with returning customers. “With this feature, you can store customer information. So it’s really popular with doctors, chiropractors, and anyone with return customers,” he says. He also recommends this payment gateway for magazines, newspapers, and even convenience stores. This is because of the “recurring billing” function.

For our second gateway processing option, we offer SwipeSimple. SwipeSimple has online payment options and in-person payment options. It’s great for businesses that sell online and in-person, and who want one system to monitor it all. “It’s everything you need to run a business from your computer,” Andrew says.

Check out this free SwipeSimple demo https://app.swipesimple.com/demo/. Play around with it and get comfortable with the controls. You won’t break anything.

Why use one?

The ability to accept payments online is truly a blessing.

“Customers are shopping online,” Andrew shares. “In 2021, 2.14 billion shoppers were online. They say it makes sense to be where your shoppers are. It’s the same thing for online shoppers,” he explains.

Andrew provides another fast fact. He says customers are more likely to make impulse purchases online. In fact, 77% of online shoppers make an impulse purchase.

Here are 4 reasons you should offer online checkout:

- Forget business hours—you can reach customers no matter what time it is.

- Reach millions of potential customers.

- Drive customers directly to your online store. Use email and digital marketing campaigns.

- Shopping online is convenient and consumers prefer convenience.

There are even more reasons your store needs ecommerce, which you can read about here.

In order to accept online payments, you need a payment gateway. We have two different payment gateway solutions. Some of their features include the following:

How much do payment gateways cost?

Payment processors often have any number of fees for payment gateways. Here are our rates for payment gateways:

- SwipeSimple subscription: $15/month

- Acumen Connections Gateway subscription: $20/month

What should I look for in a payment gateway?

For starters, it’s essential to ensure you use a payment gateway that doesn’t cost an arm and a leg.

Worried you’re spending too much on your payment processing or payment gateway? Schedule a free rate review with us. It’s a service we offer to our customers and other businesses at no charge. We’ll review your payment processor’s statement with you and tell you what each expense covers. We’ll also let you know which fees are necessities and which fees you could go without. Our goal is to help you save money on payment processing services and products. Contact us today to schedule a free rate review.

Next, work with a payment processor that provides payment gateways and solutions for in-person checkout.

Can a payment gateway be bundled with other payment processing services?

Yes, a payment gateway can be bundled with other payment processing services. A payment gateway only allows you to accept payments online. So, if you want to accept credit cards in person, you’ll need other technology to get you there. You can accept in-person payments with a card reader or card machine.

At Acumen Connections, we have a variety of in-person payment solutions as well. They’re all made to keep your checkout process smooth and convenient for your team and your customers.

If you expect to make payments in-person and online, SwipeSimple is a perfect solution. SwipeSimple is a point-of-sale software service. It allows you to accept payments via mobile apps, terminals, and online. It’s super easy to manage your company’s sales from one account.

Speaking of convenience, you want a payment gateway that will integrate with the services you already use. Luckily, our payment gateway options do just that.

How do I integrate it into my sales?

Work with a payment processor that makes switching a seamless process. You can choose a payment processor that integrates with the services you already use. At Acumen Connections, our services integrate with over 40+ popular tools! This includes QuickBooks, WordPress, WooCommerce, Shopify, and more!

Conclusion

With the information above, we hope we’ve given you a better understanding of how a payment gateway works. Moreover, you should have an idea of how you can use a payment gateway to benefit your business. Whether you own a daycare, a moving company, or a dental practice, having online payment options lets your customers make online payments for your services.

No matter your choice, payment processing experts like Andrew with Acumen Connections can help you get set up. Our goal is to make it as seamless as possible. Contact us today to get started.

Anna Reeve, MBA