6 tips to simplify small business accounting

Accounting is one of the most crucial functions necessary to run a business. Not all business owners are accounting pros or wish to incur the expenses of hiring a professional accountant. We have some tips for getting your books done yourself. Let’s explore small business accounting together!

Being a small businesses owner can be a lot of work. You oversee a plethora of business-related activities with minimal help. In addition to sales, customer service, and staffing, there are other essential functions. One such vital function is accounting or bookkeeping. Small business accounting is its own niche. It has nuances that often don’t apply to large corporations.

Level up your payment game

Take payments with confidence. Make our YouTube channel your go-to for all things payment processing.

In the world of business, numbers have enormous power. As a business owner, you need to be aware of your numbers from the top-line to the bottom-line, and everywhere in between. That means having a pulse on expenses like payroll. If you’re starting an online business, you’re likely navigating various aspects of running a business. We’re here to help.

Accounting is the health of your business as told by numbers. It is a quantitative analysis of how your business is doing. Are you generating enough revenue? Are you overspending in certain areas? What does tax season look like for you? These are questions that can be answered through accounting.

Let’s begin!

6 best tips to kick-start your small business accounting

How do small businesses maintain basic accounting?

Most small businesses may not have an in-house accountant or accounting team. Usually, the business owner or manager does the bookkeeping. We’ve listed a few strategies to help small businesses take charge of their accounting.

1. Keep track of expenses

At the core of effective bookkeeping lies expense tracking. You need to maintain accurate records of your expenses. The goal is to keep your finances updated. We suggest establishing a system for organizing receipts, invoices, and other documents. You could use a service like Shoeboxed or Smart Receipts.

Keep an eye out for a few specific types of receipts. These include:

- Business meal bills

- Business travel expenses

- Vehicle expenses

- Gift receipts

- Home office invoices.

Be sure to make note of details regarding who incurred those expenses and their purpose. We recommend writing that on the back of all receipts.

If you have items for both personal and business use, please remember to document them as such. You can deduct the portion solely used for business and expense the same.

2. Have a bookkeeping system in place

Bookkeeping is the first step in the accounting process. It involves recording and organizing all day-to-day transactions. You could either use software like QuickBooks or use an Excel spreadsheet.

Acumen Connections integrates well with popular accounting software like QuickBooks. Want to streamline your payment collection process? Contact us today to learn about our risk-free trial.

You can find a collection of free downloadable small business accounting Excel templates here.

Alternatively, you might hire a bookkeeper service via outsourcing if you have the means.

Picking an accounting method

There are two methods employed by businesses when it comes to accounting. They are:

Cash Method – Revenue and expenses are reported on financial statements only after receiving payment.

Accrual Method – Revenue and expenses are reported at the time of the transaction, usually before a payment is made, expecting that payment will be made in the future.

Most small businesses in the United States use the Cash Method. It’s best for companies that earn less than $5 million in revenue. Exceeding that amount requires the use of Accrual Method.

3. Setting up a payroll system is vital

If your small business has employees, a prime step is setting up a payroll system. Review Federal and State Employment Laws first. Then pick a payroll schedule.

Your payroll schedule determines how often your employees get paid. Your payroll policy details schedule, benefits, guidelines, etc. It’s drafted to avoid liabilities.

Deciding how frequently your business should run payroll is crucial. Payroll is typically a large expense and can have a significant impact on business cash flow. Be sure to check local regulations on payroll scheduling. There are state and federal regulations. They may provide rules on frequency, minimum wage rates, and even overtime.

Once you know your legal restrictions, there are four different frequencies to choose. Compare our list below to see what works best for your team.

Weekly payroll: Workers are paid every week, usually on Fridays. This causes a fast cycle of paydays. It works best for hourly employees. It provides a level of trust that they’ll be paid for the work they do. They can see the immediate result of their labor, especially if they work more or less time. This is the most expensive payroll frequency. Many payroll services charge a fee each time payroll runs.

Biweekly payroll: Workers are paid once every two weeks. Payday usually falls on every other Friday. This payroll frequency is quite common. Employees often know how it works. That familiarity makes them feel comfortable. Because of that, it’s a great pay frequency for teams with hourly and salaried employees. Unfortunately, this is the second most expensive payroll schedule. In addition, some years this schedule can lead to an extra pay period. This can cause employee overpayments if not careful.

Semimonthly/Bimonthly payroll: Workers are paid twice a month. Typically, payday falls on the 15th and the 30th of that month or the 1st of the following month. This cycle is like biweekly frequency and is often mistaken for it. However, there are two fewer payroll processes than the biweekly schedule. Therefore, this schedule saves a little money. This cycle of pay frequency is best for salaried employees.

Monthly payroll: Workers are paid once each month. This payment schedule may be the most affordable. It has only 12 payroll charges in a year. It’s recommended for salaried employees only since their wages tend to be higher. Yet, most employees do not like this system of payment. They often receive a large payment once per month. Many struggle to manage that amount for the next 30 days. If they run into financial trouble, they don’t have another payday coming for a long time.

4. Establish a system to collect payments

When a customer purchases from your business, you have an accounting responsibility. You need to set up a system to accept payment and create a receipt. The receipt can be printed or sent digitally. You could wait months for a check or cash. That is, if it doesn’t get lost in the mail. Or you could get paid faster with a payment processor.

You will want card readers to accept debit and credit card payments. A payment gateway will offer you a secure way to collect online payments. At Acumen Connections, we take care of your card payments. That allows you to focus on other areas of your business.

We make getting paid easy. Get in touch with us. We’ll help you find the products and plans that suit your business needs.

5. Gross margin matters!

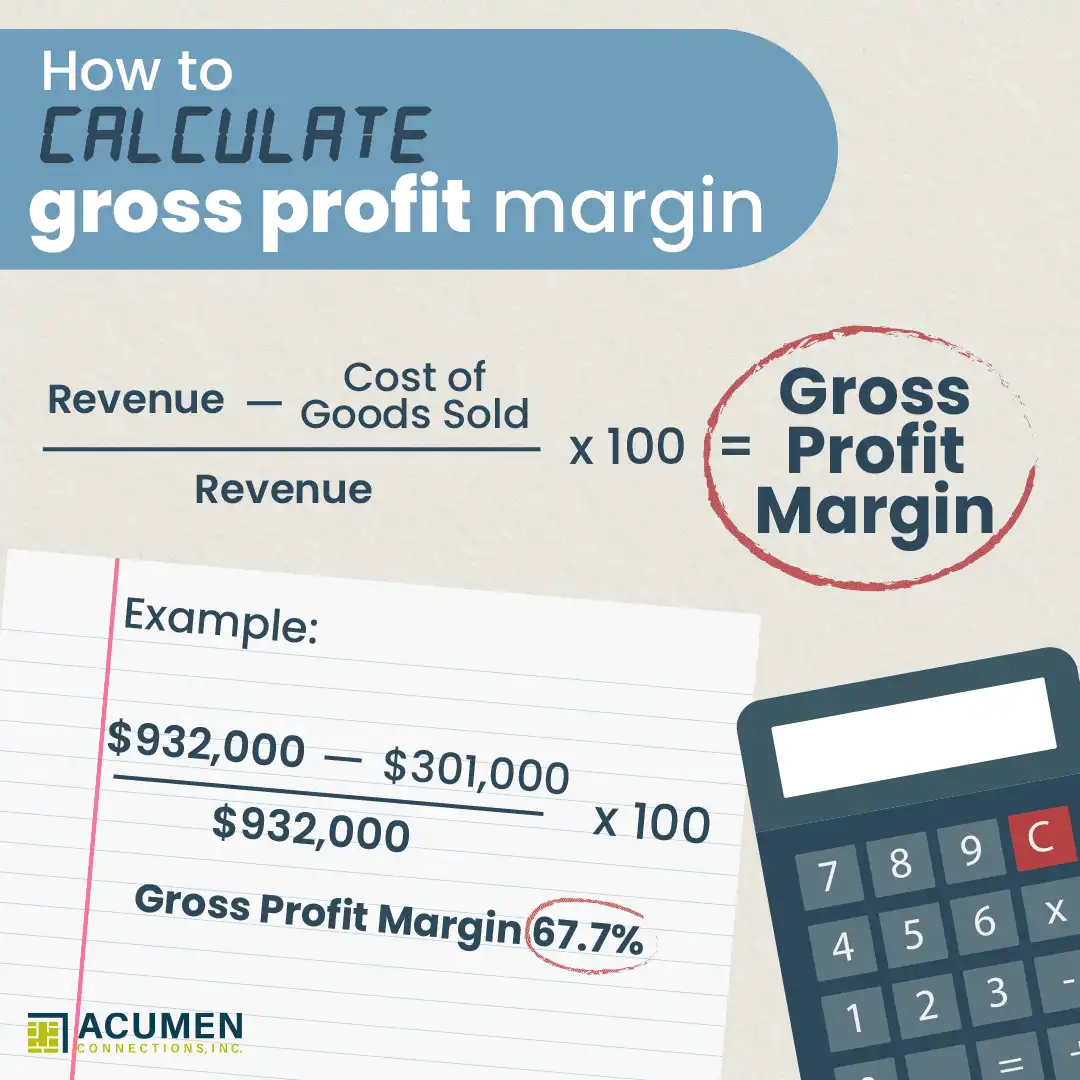

Small business accounting calls you to be mindful of your numbers. These numbers reflect the overall health, growth, and sustenance of your business. Gross margin is the revenue after deducting all direct costs (labor cost and cost of materials) necessary to produce a product or service. To generate more income, you must raise gross margin.

You can calculate gross margin using the following formula:

(Revenue – COGS)/Revenue = Gross Margin (%)

COGS stands for Cost of Goods Sold. It’s the direct costs of materials and labor that went into producing your products or services.

A gross profit margin of 50-75% is considered healthy.

6. Evaluate and analyze your methods

There is often some level of trial and error in small business accounting. We recommend evaluating your current systems. Conduct cost vs benefit analyses. If something is taking up a lot of time, consider investing in an alternative. That will be a more fruitful decision in the long run. Make changes if you believe the current procedures could be improved.

When should I hire an accountant for my small business?

“How much should I pay an accountant for my small business?” is a common question. The answer? It depends. Do you have the funds to hire someone?

Let’s compare a couple of common accounting costs.

Accounting software: $30/month

Outsourced bookkeeping: $500/month

*Part-time bookkeeper: $2500/month and benefits

*Full-time bookkeeper: $3,300/month and benefits

*Metrics from Ziprecruiter and Indeed

Often, small businesses try to keep their accounting costs low. As small companies grow, accounting responsibilities often start with the owner. Then they move to a manager (or managers).

When a company becomes large enough to hire a full-time bookkeeper, many companies continue to save money. Accounting and payroll are often hand-in-hand. This means accounting responsibilities and human resource responsibilities are often shared by the same individual or department.

Conclusion

How one runs a business differs from person to person. However, the basic principles remain the same. You want to make a profit, and you want your business to grow. Growth and expansion may be highly desirable. So, managing your books forms the backbone of your business. You want your numbers to be favorable. That is why accounting is an area that needs to be handled with accuracy and precision.

Small business accounting requires close monitoring. Depending on your bandwidth and resources, you should invest in a strong accounting system. After all, it’s one of the fundamental requirements of every business. Happy number crunching!

Anna Reeve, MBA

You made a good point when you mentioned that it is important for your business to make a profit and grow. I would think that working with an accountant would be a good idea because they could help you set realistic growth goals. Having realistic growth goals would be a good way to help you know what you need to do to expand your business.