The right credit card processing company can work wonders for your business

Accepting card payments is essential and paying for credit card processing is a cost of doing business. It’s common to get frustrated with the fees of a merchant account, especially if you feel tied down to your credit card processing company. That’s why it is important to choose wisely.

89% of consumers in the United States use digital payments. In 2023, the digital payments revenue generated in this country stands at $2.04 trillion and it is projected to reach over $3.5 trillion by 2027. These are steep numbers that only show that every business today needs to accept cashless payments.

To take credit card or debit card payments along with online payments and digital wallets, you want to work with a reliable credit card processing company, which may also be called merchant processors.

Payment processing is simply a cost of doing business. But sometimes that cost can be overwhelming. That shouldn’t be the case. Choosing the right credit card processing company is an important business decision . Nothing is set in stone, and you can always change your mind but sometimes that comes at a cost. That’s why it’s important to do your research before choosing a payment processor – which is exactly why you’re here. Keep reading to discover the essential factors to consider when choosing a credit card processing company.

How to choose the best credit card processing company

Choosing the right credit card processing company can make or break your business strategy. Yes, it is that important. Making a poor choice can have consequences beyond just the financial drain in fees. We’re talking about aspects like customer satisfaction, customer retention, and customer loyalty. You can’t build a successful business without considering the human emotions of your customers.

The rule of thumb is: Put your customers first. Your business exists to solve a problem or offer a solution to something a customer faces. Make it easy for them to choose you over the competition while getting paid in time.

Can you keep a secret? Because we can’t!

We’re not great at keeping secrets. So, here’s the truth: You have options! As a credit card processing company, we know the ins and outs of the industry. We not only know what the payment processing competition is doing, we also know that you deserve better.

Woah, slow down! Do the words ‘payment processor’ have you heading for the hills? Hang with us. We’re not like the others. We try to not be. Hear it from Brian Staver, our company president. He took over Acumen Connections because he was tired of traditional payment processors. Brian is an entrepreneur at heart and has started several businesses. Brian’s goal was to create the payment processor he wanted to work with.

- No lengthy contracts

- No high rates.

- No locked-in fee structures.

So, that’s the kind of processor he created with Acumen Connections. We’re unique like that!

Businesses often feel like other merchant processors take advantage of their merchants. We take advantage of technology and premier customer service to give you the best experience possible.

If your current company is doing any of these, it might be time to switch processors.

Let’s look at the factors that matter when picking a payment processor.

Choosing the Best Credit Card Processing Company

Remember, your business depends heavily on your ability to process payments of all kinds. That’s why choosing the right credit card processing company is a key business decision.

When looking for a credit card processing company, check this list of must-dos before you pick one. Here’s five essential factors to consider, including ones you didn’t know existed. Check it out!

1. Do some thorough research – you’ll be glad you did!

Nothing beats a good old-fashioned Google search, does it? Now bear in mind that when googling credit card processing company, or anything at all, there could be a few sponsored ads at the top of your search results. Also, large payment processing companies have thousands of customers and they’re usually more catered towards bigger businesses. Their customer service helplines are likely to be automated and it could be a while before you get to speak with an agent.

We suggest going with smaller processors that will relate to your wants, needs, goals, and aspirations as a small business owner. Besides, nothing can come close to the level of personalized attention you can get from local or smaller merchant processors over a large corporate that possibly serves other large companies.

When we say research, we mean really get into it.

- Read real customer reviews on Yelp, Trustpilot, and Google.

- Check out their website to learn more about their brand and services.

- Go down a rabbit hole as you explore their social media pages.

- Explore their blog to see if they’re publishing new content routinely.

All of these factor into how dedicated a credit card processing company is. Choose a processing company that other merchants actively enjoy partnering alongside.

2. Avoid paid and sponsored review websites like the plague!

During your research, you’ll come across your fair share of sponsored or paid review websites. What this means is that oftentimes, a credit card processing company will pay to be featured in the top spots on a website reviewing credit card processors. If you look closely, you may see a disclaimer stating that if you use the links to visit these processors, the website makes a small commission. This is called affiliate marketing.

With sponsored review sites, merchant processors are literally paying to be at the top of the list. Where’s the integrity in that? These review websites will spotlight whichever company pays them the most.

Popular examples of such review websites are creditcardprocessing.net, paymentprocessing.com, best10merchantservices.com, toptenreviews.com, and more. We have nothing against websites like these as they serve a purpose. We just want you to be aware that some of their recommendations paid for the top spots.

3. Don’t compromise on equipment & technology

There is no substitute for top-notch technology and equipment. Along with updated tech, you also need equipment compatibility.

With the rise in contactless and online payments, you can’t afford to turn down a sale simply because you can’t process a transaction. Most merchant processors identify and correct compatibility issues early on but there’s a chance that one might neglect these issues.

Acumen Connections can help put the right credit card processing equipment in your hands. Plus, we stay up on the latest updates. We’re always up on industry trends. You never miss a beat. Our swaps are seamless — unlike Indiana Jones’ idol swap in Raiders of the Lost Ark. You won’t be chased by a giant boulder.

Acumen Connections integrates with most every inventory system. Our systems integrate with QuickBooks, Shopify, WooCommerce, and Aloha, just to name a few. And, we do that work for you!

4. Pricing and fees matter

Processing rates seem always on the rise, don’t they? Businesses everywhere hate seeing an extra charge from their credit card processor and we completely understand that because most merchant processors are notorious for advertising low “introductory” rates and fees, then raising them after you’ve signed into a term contract. You know, the classic “bait-and-switch.” We hate such gimmicks and we know you do too.

Interchange fees make up a large portion of your processing costs. Typically, these fees are updated twice a year by the big card companies, and it’s not unheard of for some merchant processors use this as an excuse to markup their fees. There are some management and account fees as well that are added to your bill.

While some fees are legit, others not so much. The least a provider can do is be honest and upfront about what they charge before locking you down with a contract.

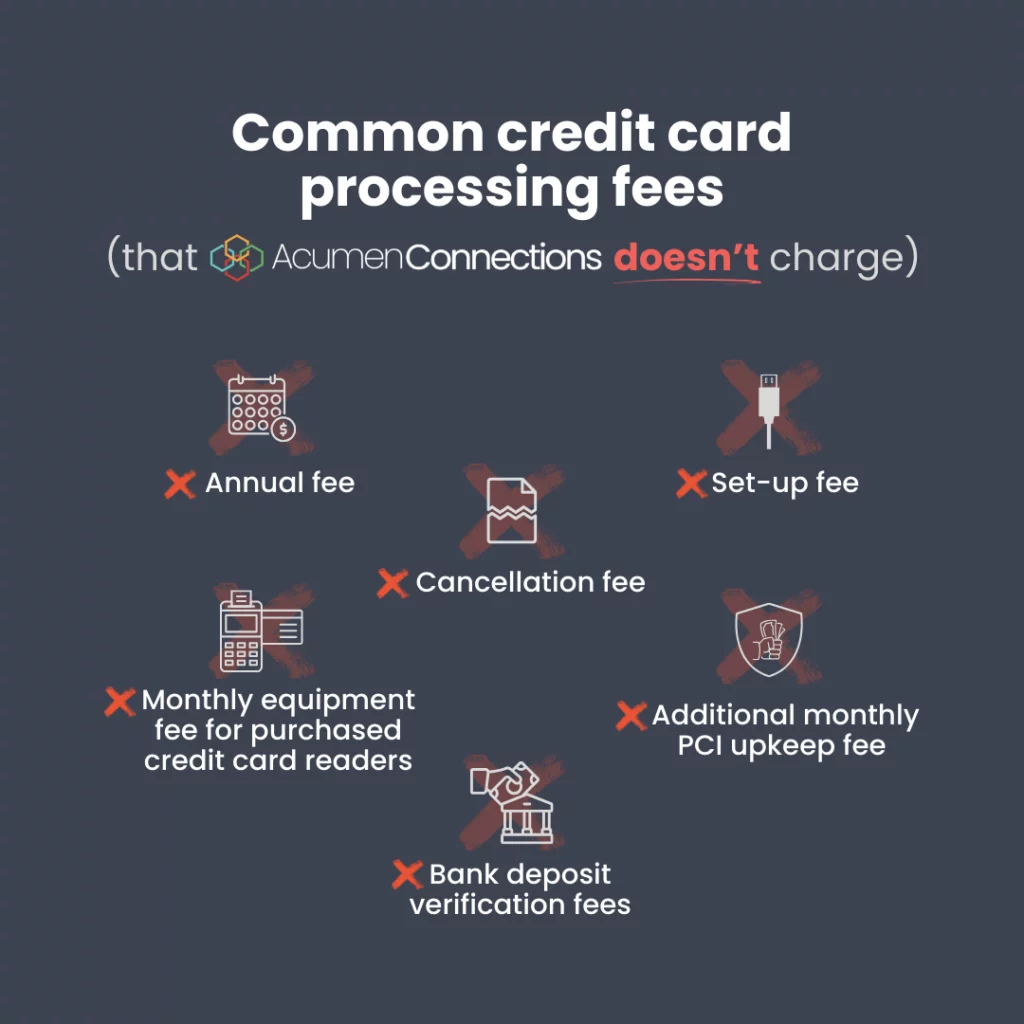

At Acumen Connections, we don’t charge certain fees that other credit card processors might such as:

If you’re getting charged the fees listed in the graphic above, it might be time to switch payment processors.

It is interesting to note that most of our merchants aren’t charged a monthly minimum fee unless we’re already saving them a lot of money with our dual-pricing merchant discount program, and even then, their processing fees have been eliminated!

Most payment processors charge an annual PCI compliance fee and monthly PCI upkeep fee. While we do charge the annual PCI compliance fee broken up into quarterly amounts, we don’t charge an additional monthly upkeep fee.

We have devices for purchase or rent. If you’ve purchased and paid for a credit card reader in full, there’s no sneaky monthly charge to use the device you’ve already bought.

Who wants to pay an arm and a leg to a credit card processing company? Nobody! Luckily, with Acumen Connections, you don’t have to worry about sky-high fees. We walk the extra mile to give you lower rates and save you money. To sweeten the deal, we even throw in a merchant discount program for our clients that want to eliminate their payment processing fees.

5. Contract Terms – Strings attached?

Not all relationships have strings attached. We can keep it casual, you know.

Try us and you’ll fall in love with us… or with our risk-free program. There are merchant processors that will try to rope you into a contract with penalties for opting out. We don’t believe in that.

Lets just say it – lengthy contract terms are a pain! To get a good introductory rate, a credit card processing company might require you to sign a two or three-year contract. Once you sign it, you’re basically locked in and closing your account could be tricky and expensive as penalties for canceling a contract are hefty. We’re talking thousands of dollars. Even worse, merchant processors who tack on significant fees are often the ones that charge early termination fees.

Acumen Connections will be transparent with you on your contract agreement. We won’t let you sign anything you don’t fully understand. Oh, and did we mention that we don’t charge cancellation fees? We’re so confident you’ll enjoy working with us that we ditched cancellation fees altogether.

What makes Acumen Connections a top pick?

We’ll be honest here. We’re not perfect but we’re pretty darn close to perfection!

It’s basic human nature to want and seek perfection in everything that matters. We want the best in life and as business owners, we want the best from our credit card processing company. We know you might still be on the fence about us. Maybe you didn’t have the best experiences with credit card processors in the past and we totally understand if you’re hesitant to try us. What makes us a top pick? Our integrity, unparelled customer service, and resource hub of a website all contribute to creating a consistent user experince for our merchants. Plus, we do have quite a few 5-star reviews on Google that offer all the social proof you need.

Did you know that we could do a free statement analysis review for you? Go to our website and upload a copy of your statement and we will review it to determine where we can save you money.

Bonus tip: Customer Service and tech support – as helpful as they come!

One of the most important things you want in your credit card processing company is supreme customer service. Sadly, few consider the importance of good customer service until they need to use it. Sadly, not all customer service is created equal. Some merchant processors tend to focus more on acquiring new accounts than they do taking care of the ones they have.

Nobody likes to be put on hold indefinitely when they call their provider about an issue. Some merchant processors outsource customer service operations. Or worse, replace it with an automated answering machine. Neither is the most helpful. You want someone that’s attentive to your needs and offers you the best solutions in a timely manner.

Working with a provider that specializes in small and medium-sized businesses is your best bet. When you work with a credit card processing company like Acumen Connections, you unlock access to a dedicated merchant processing support team comprising of trained professionals that cater to your needs while empathizing with whatever it is that you’re dealing with.

There are tell-tale signs that a business has good customer service support such as an in-house support option with a designated point of contact, and the other one is reputation. Businesses, like Acumen Connections, use Trustpilot and Google for customers to leave reviews. The Better Business Bureau is another worth checking out.

Point being, you deserve on-site support and a person who knows your business. Acumen Connections has (human) support that can work with you to resolve any issues or questions. Our support team is local, in Kansas, and can provide comprehensive support.

Ready to experience the Acumen difference?

Choosing the right credit card processing company for your business isn’t child’s play. There’s a lot at stake. Your customers have expectations, and you have business goals to meet. Our goal is to offer all the information needed before you decide.

At Acumen Connections, we believe in integrity and open communication. We keep things simple and transparent. Life is complicated as it is, payments shouldn’t be complicated too!

So, when is the right time to give us a call?

There’s no time like the present!

Anna Reeve, MBA