How does payment processing work? – The key parties that work together to process payments

Our world is going cashless! We’ve replaced cash with cards and problems with solutions. It takes just a swipe of a card to avail products and services. To understand how it works, today we’re taking a look at who the payment processing players are, and how they work together to make credit card transactions to go through.

We’re in the age of payment processing. Isn’t that intriguing?

Modern history has witnessed several great inventions and discoveries. We use a lot of them in our day-to-day lives. Common examples are the internet, Wi-Fi, electric vehicles, smartphones, GPS etc. When carrying cash and checks became a pain, credit cards and debit cards came to the rescue. They conducted transactions between buyers and sellers. And they ensured smooth transfer of funds between the two parties. It’s impossible to even entertain the idea of not having cards. Imagine not having credit or debit cards! The picture is scary and anxiety-inducing!

These little pieces of plastic are so easy to use to buy things. In fact,

80% of consumers prefer to use card over cash. Want to know the secret behind debit and credit cards? Want to know what makes them tick, what makes them work? The secret is: payment processors.

What is a payment processor?

A payment processor is the mediator between the customer’s bank and the seller’s bank. It enables a customer to check out with convenience. A payment processor vital part of performing card transactions.

You’ve done it, and you’ve seen others do it. In stores, customers swipe their magnetic stripe cards to pay. They may even tap contactless cards or use digital means of payment like Apple Pay on their smartphone. Online customers enter their card information in a secure payment getaway. These options save people from having to carry cash and checks everywhere.

Learn more about

payment processing…

How does payment processing work?

A customer enters payment information to the payment processor. The payment processor contacts the customer’s bank through card networks. The bank may accept or reject the transaction depending on several factors. When the bank approves the transaction, it communicates it to the payment processor. It is then relayed to the terminal or card reader. The customers’ accounts are charged, and the money is deposited into the merchant’s bank account.

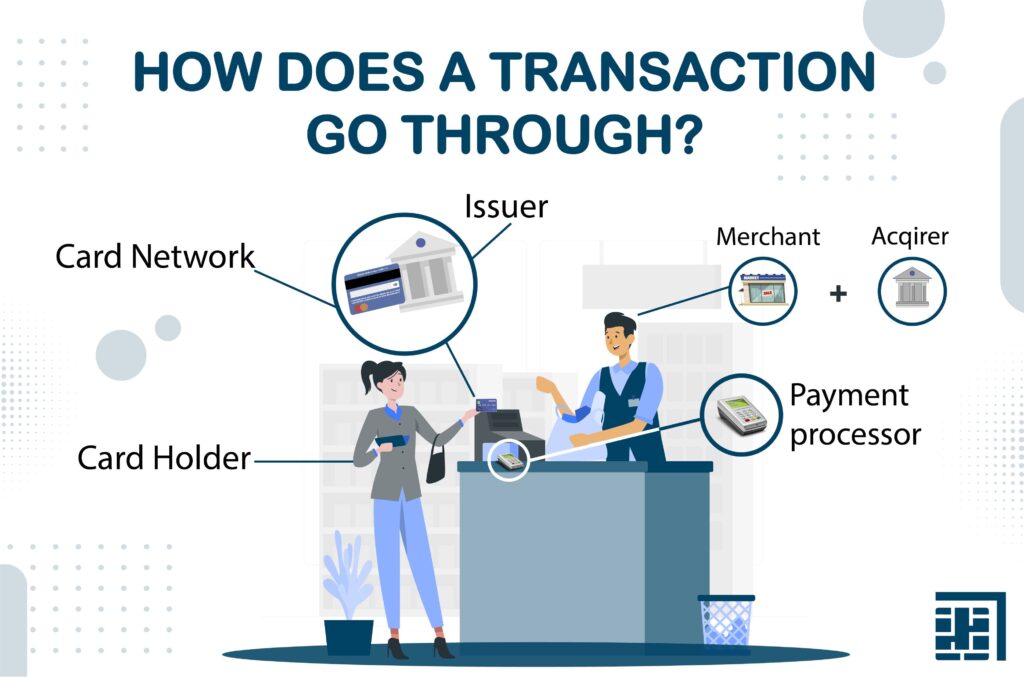

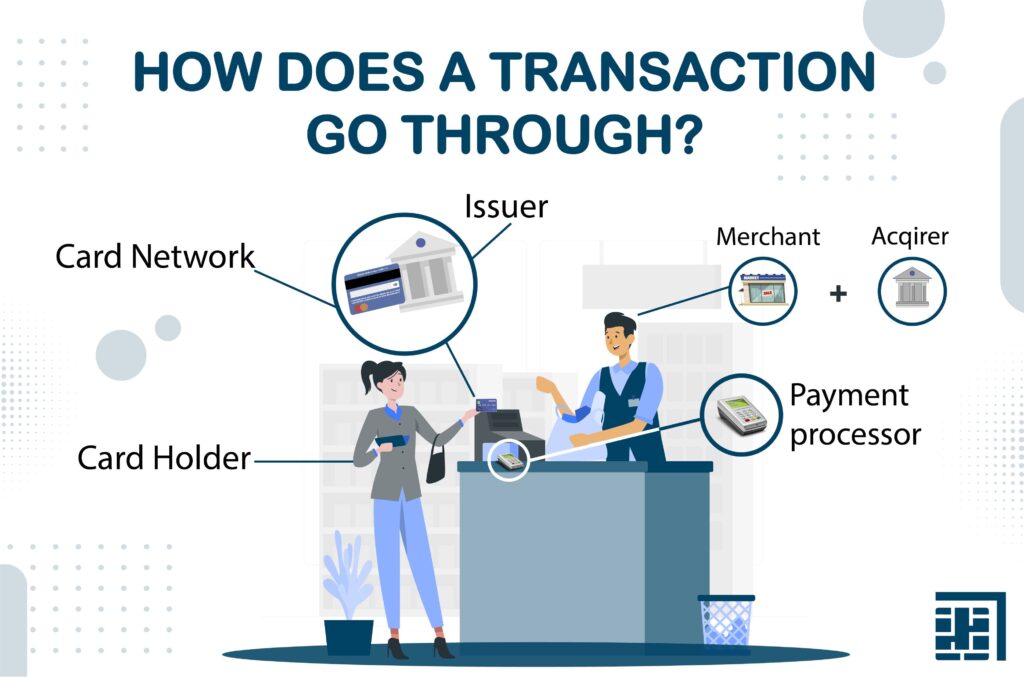

What are elements of payment processing?

We’ve touched on payment processors and how they work. Let’s delve into the key elements in the process.

These are the businesses and individuals that work together to make a sale go through. We have described them below:

1. The cardholder (the customer):

This is the first element involved in payment processing. The customer is the person or business that avails a product or service. If you’re buying shampoo at a store, you are the customer. If a company is purchasing supplies, that company is the customer. In simple terms, the customer is the buyer. They pay for their purchase using a credit or debit card. That’s why customers are also called cardholders. There are two types of cardholders – Transactor and Revolver. Transactors they pay their credit card balance in full. Revolvers repay a portion of the balance. They accrue interest on the unpaid balance.

2. The issuer (the customer’s bank):

This is the bank that issued the credit card used in the transaction. A customer needs to present their credit card information to make a purchase. The bank then receives an authorization request from the credit card network. Banks and other financial institutions can approve or deny transactions. Denial can be due to several reasons.

3. The card network (the credit card company):

Under the umbrella of credit card company are two facets. They are –

issuer and network. The issuer is the bank or financial institute that issue credit cards. And the network are companies that process credit card transactions. Visa and MasterCard are two most common networks. The network ensures that transactions are assigned to the correct cardholder. This is so that the issuer can bill them.

4. The payment processor:

This is the company that offers terminals and card readers for in-person transactions. And they set up payment getaways for online transactions. It serves as a liaison between the customer’s bank and the merchant’s bank. A payment processor can enhance or ruin a customer’s shopping experience. If you own or manage a business,

contact us to know about our services. We would be happy to answer any questions you might have. Our team could recommend the best products suited for your business.

5. The merchant (the store):

The merchant is the business or company the customer made a purchase from. Merchants are responsible for having reliable payment processors. This ensures secure transactions and speedy checkout. They accept credit and debit card payments. The merchant sends card information to the cardholder’s bank. It sends them payment authorization requests through the credit card network.

6. The acquirer (the store’s bank):

This is the final piece of the puzzle. It is the financial institution where the merchant has a business account. Funds are deposited to the merchant’s account at the end of a transaction. As they obtain or acquire the funds, they’re often called the acquiring bank.

Payment processing occurs when all the above elements perform their function. There are times when banks decline credit card transactions. This could be for reasons other than maxing out the card. Some card companies decline global transactions. It could be due to technical errors by the customer’s bank. Frequent online purchases could prompt banks reject to a transaction request. This is an attempt at fraud prevention.

Why do we need payment processing?

A reliable payment processor is essential for businesses. You want your customers to be able to shop online and in-person. And you don’t want them to get overwhelmed. A major chunk of customers like to shop online. This makes having a secure payment getaway a must-have.

Want to avoid losing your customers to your competition?

Just make their experiences more positive! Better customer experience leads to customer retention. Customers switch brands if they struggle with payment and checkout. A secure and dependable payment processor can help. Your customers will be more likely to recommend you to their contacts.

Final thoughts…

Along with products and services, a business needs excellent customer care. Customers need to be able to shop and make quick payments. A fast and convenient checkout is a huge part of customer experience.

You might have traditional counter-top terminals. But do you own or manage a large store? If you do, a portable card reader might be just what you need. That way your checkout aisle will not be too busy. And Customers can pay from anywhere in the store. They won’t have to wait in line for a long time.

Do you deliver your products to your customers? You could collect payment at the delivery address. Do you offer services like plumbing, cleaning, roofing, landscaping? These happen at locations assigned by your customer. Not all people keep large sums of cash on them. A portable reader can save you the hassles of checks. A quick swipe and payment received!

Learn more about

payment processing for your unique small business.

These perks make it worthwhile to invest in a payment processor. We know you care about your customers. Let us take care of you.

Acumen Connections is a locally owned and operated payment processor in Wichita, Kansas. Our organization seeks to help small businesses meet their goals with real solutions designed by real hardworking people. To help businesses and individuals achieve personal and professional successes, we’re providing new content weekly. Stay up on our posts by visiting the Acumen Connections Facebook, Instagram or Twitter pages, and visit the blog for a full catalog of resources fit for hardworking people.

These are the businesses and individuals that work together to make a sale go through. We have described them below:

These are the businesses and individuals that work together to make a sale go through. We have described them below: