There could be a credit card skimmer lurking around. Get your guard on!

Are card skimmers still a thing? Yes, they are still a thing! My card was skimmed this year and to prevent other unsuspecting consumers from falling prey to a credit card skimmer, I decided to identify the tell-tale signs. Keep reading.

Isn’t the modern world intriguing? We get computers, and soon enough we get computer viruses. We get internet, and bam! We also have online scams and scammers. It’s almost as if every great invention comes with something sinister or negative. I know, I sound like a Debbie Downer, but you can never be too careful when it comes to the things that matter and, in this case, it is your finances.

I can’t imagine a life without credit cards! How else am I going to pay for my essentials? I don’t want to carry all that cash every time I go grocery shopping. Writing checks isn’t as convenient either. Credit cards are definitely the way to go and that’s why in the United States, 84% of adults carry at least one credit card in their wallet. As a merchant processing provider, we know credit cards are an important part of all our lives, and we will continue to use them. That’s why it is important to stay safe while making payments.

Seamless integration, effortless payments

Keep business running smoothly. Our solutions integrate with popular programs

What is a credit card skimmer?

A card skimmer is a physical device used by criminals to steal the card information of unsuspecting victims. They are hooked up to payment terminals and credit card machines. When someone’s credit card interacts with them, they copy or skim off card information which is then stored in the device itself for misuse in future. Criminals use the stolen card information to buy things for themselves.

You are most likely to encounter a credit card skimmer at an ATM or at a gas station, as these devices may not be closely monitored. Although other businesses with card terminals are just as likely to become hosts. From retail stores to mall kiosks, there is no telling where a card skimmer might be lurking as criminals get better and more brazen by the day.

If you’re a business owner, we recommend checking your own credit card readers from time to time.

How does a credit card skimmer work?

A credit card skimmer records and stores data every time someone swipes their card into a compromised card reader. It “skims” essential information like credit card numbers, card holder’s name, expiration date, and CVV. In short, a credit card skimmer will obtain all the details necessary to make transactions on behalf of the victim.

The bad actor(s) will be back at the scene to retrieve the credit card skimmer they had previously planted along with card information of anyone who had swiped their card.

Pro tip: Sign up to receive alerts on your phone every time your credit card is used to make a purchase. These won’t prevent you from having your card skimmed, but it’s a convenient way to immediately tell if someone else uses your card to make a purchase.

How do I know if I have a card skimmer?

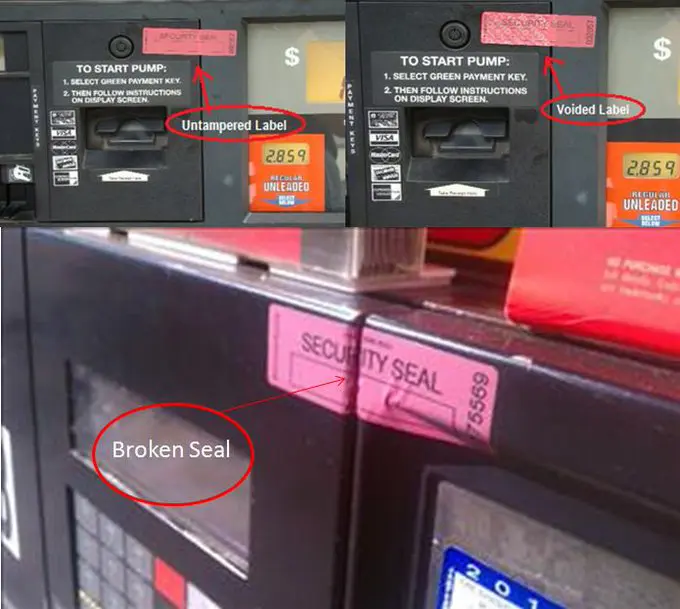

You’ll know if you have a credit card skimmer by doing a thorough visual inspection of a credit card reader before making a transaction. A credit card skimmer can be detected if you look closely. Sometimes, the stripe reader might bear a weird angle, or the keypad buttons are awkward to use. Try to pull and tug at anything that looks out of place. There should not be any wobbly or loose parts. Also, a quick comparison with a nearby terminal might help eliminate doubts in some cases. If a card reader looks bulky, refrain from using it.

A credit card skimmer isn’t just a concern in big cities. Even Kansas gas station fell prey to them.

3 ways to spot a credit card skimmer

There are a few ways you can go about identifying a potential credit card skimmer should the situation arise. Take a look:

1. Look for signs of tampering

Oftentimes when installing a credit card skimmer, a few noticeable changes happen to the terminal. Do you see a bulky attachment that doesn’t usually occur at terminals? Does the keypad look typical or do the buttons look like they are off-center? Look for signs that aren’t the norm on credit card devices such as loose or wiggly card slots.

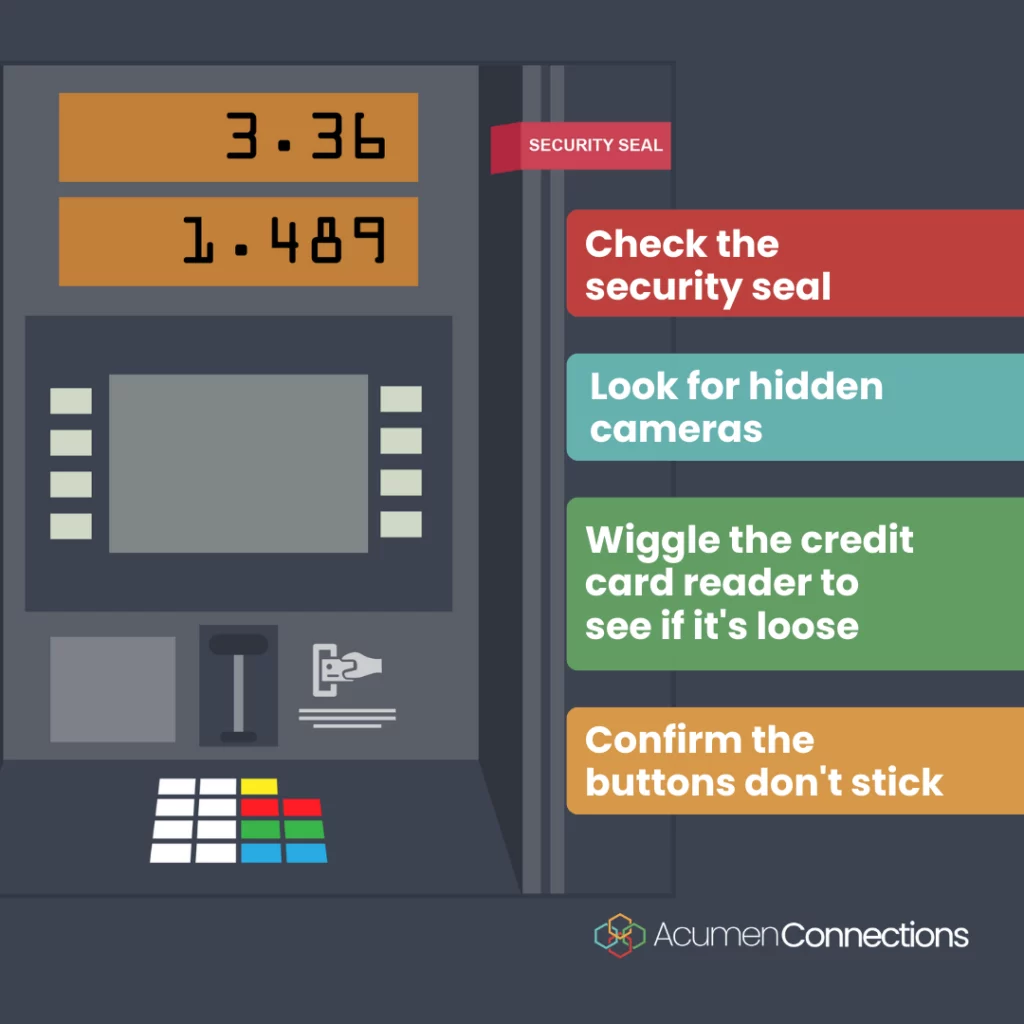

Here’s a list of things I do when trying to spot a credit card skimmer:

- Check the security tag – it shouldn’t be void or cut

- Watch out for hidden cameras or cover the pin pad when typing numbers

- Try to wiggle the card reader – it shouldn’t be loose

- Check the pin pad buttons don’t stick – they shouldn’t

- If there’s other card readers nearby (like at a gas station) confirm they all look identical – they should

When at a gas station, I try to use the pump that is closest to the gas station building because it is usually in the cashier’s line of sight and less likely to be compromised.

2. Watch out for cameras

Some criminals take an extra step and try to capture a victim’s PIN number by using a camera. These cameras are small and placed strategically above a pin pad to avoid detection. As a rule-of-thumb, use one hand to shield the keypad as you type in your PIN.

If you can avoid the keypad entirely, please do so. The less contact you have with a terminal, the better it is.

3. Use a skimmer detection app

Mobile apps have revolutionized modern day life in so many ways. From food delivery to dating, we can do it all using our smartphones. When it comes to detecting a credit card skimmer, there are apps for both Apple and Android devices. Apple users can go to the App Store and download Skimmer Locator while Android users can get Skimmer Detector.

What does a credit card skimmer look like?

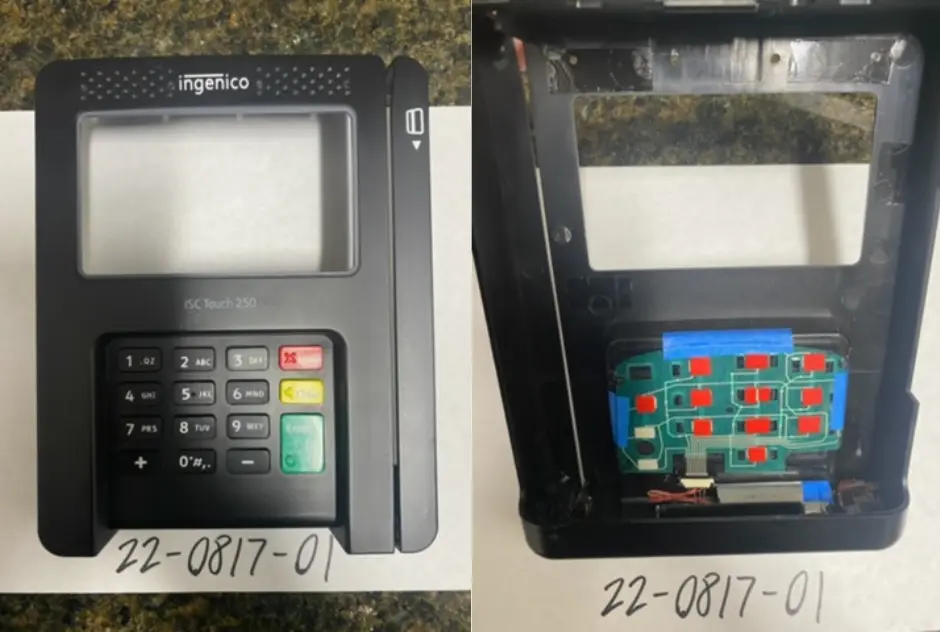

A credit card skimmer doesn’t come with major markers and is intended to blend in with the surroundings. It isn’t easy to identify a credit card skimmer, but it isn’t impossible either. For example, take a look at this credit card skimmer device the Broadmoor Police Department found. You can see it was made to look like an Ingenico credit card machine.

This credit card skimmer wasn’t used on one of our credit card readers. If that brand name sounds familiar to our customers, it’s because we carry the very popular Ingenico Desk 3500.

A credit card skimmer could be external in nature and can be detected as a bulky covering that envelops the card slot. It can be internal and exist as a small device inserted inside the card reader in a way that it is stacked in between the actual reader and a victim’s card when inserted. Or it can be in the form of micro cameras intended to capture visuals of a victim’s card.

A credit card skimmer can impact businesses as it does individuals. As a business owner, you need to be vigilant too. After all, you wouldn’t want your business to become a hotspot for credit card fraud. Part of PCI compliance mandates that business owners should regularly check equipment and securely store card readers to ensure only the people that need to use them can use them.

A bad actor (either a stranger, or even an employee committing fraud) could install a card skimmer and potentially cause harm to a business and its customers. Yes, employee fraud is real and business owners need to be aware of it.

Does tapping your card protect you from skimmers?

Yes, tapping your card can protect you from skimmers as tapping is a less vulnerable way to make a payment than swiping or inserting your card into a card reader. See more checkout solutions with Acumen Connections.

Tap-to-pay is a contactless payment method which skips the likelihood of your card getting in contact with a credit card skimmer. A credit card skimmer is usually hidden inside a card reader to record and retain card information. So, when you tap your card instead of inserting it into a card reader or swiping it, you are circumventing the risks posed by a credit card skimmer.

Are card skimmers still a thing?

Yes, card skimmers are still a thing. Even I had my card skimmed earlier this year.

It is unfortunate but true. In fact, 35.4% of all credit card fraud is due to skimming. Millions of Americans fall prey to credit card fraud each year. Did you know that credit card fraud worldwide is projected to reach $43 billion by 2026? These numbers are huge and that’s why we need to brace ourselves for a harsh reality check.

Closing thoughts

When using cards, the risk of encountering a credit card skimmer exists. What we can do about it is pay attention to the little things. Conducting quick inspections of a credit card reader before you make a payment goes a long way. The next thing is to go through your credit card statements and narrow down charges you can’t account for or identify. Any suspicious activity needs to be reported at the earliest.

Always trust your instincts. If something about a credit card reader doesn’t feel right, don’t make that transaction. We recommend carrying emergency cash if possible. Doesn’t have to be substantial amounts. You only need enough cash to go to a different location or business. Try to pay with alternative methods like checks or digital wallets. You’ll’ be glad you did!

Acumen Connections